By Roy B. Westerfield

Professor of Political Economy, Yale University

Revised by Frank Adams, Copy Editor

(Published April 1945)

Table of Contents

Table of Contents

Does Debt Influence the Way You Live?

Do You Ever Need Cash in a Hurry?

How Much Does Consumer Credit Cost?

What Does the Government Offer You?

What Kinds of Loans Are Guaranteed?

What Are the Rules and Regulations?

Suggestions for Further Reading

Introduction

Sounds like foolish question No. 999, doesn’t it? Most of us are quite sure we know the answer. Of course it doesn’t pay to get into debt. A few of us, on the other hand, may be equally sure that it’s an easy way to get things-and worry about paying for them later. “A dollar down and a dollar when they catch me” is the lighthearted motto of such folks.

But is it really as simple as that?

Are you sure your answer will stand up if you really stop to think about it? Haven’t you known even wise and prudent men who found themselves in debt? A man may not have any choice about it. Through bad luck and no fault of his own-long sickness, an expensive operation, a fire which wiped out his personal belongings-even the most independent and self-reliant of us may be forced to borrow.

And aren’t there other times when borrowing may be wise, even when it isn’t absolutely necessary? Where are you going to get the cash to make your foxhole dreams come true after “this is over”? Many a soldier who married the girl back home before he shoved off is going to return to a brand-new family, to responsibilities he never knew before. How is he going to meet them?

Can’t a loan be a wise investment?

How many of us could hope to buy homes if we had to pay cash for them in advance? Haven’t many men borrowed money to put themselves through college, and profited immensely from doing so? Could very many men start out in business for themselves without the help of borrowed capital? Isn’t it true that even the biggest corporations in this country are in debt? If you doubt it, take a look at the bond listings in the financial section of your daily newspaper.

Debt is a two-edged tool. Under some circumstances going into debt may result advantageously, profitably. Under others it can so burden a man or a family as to ruin their lives. Like any sharp tool, the best way to handle it without hurting yourself is to know its proper uses.

So, before deciding we know all about it, let’s look into this matter of debt. Some day that knowledge may pay us in dollars and cents.

Related Resources

September 7, 2024

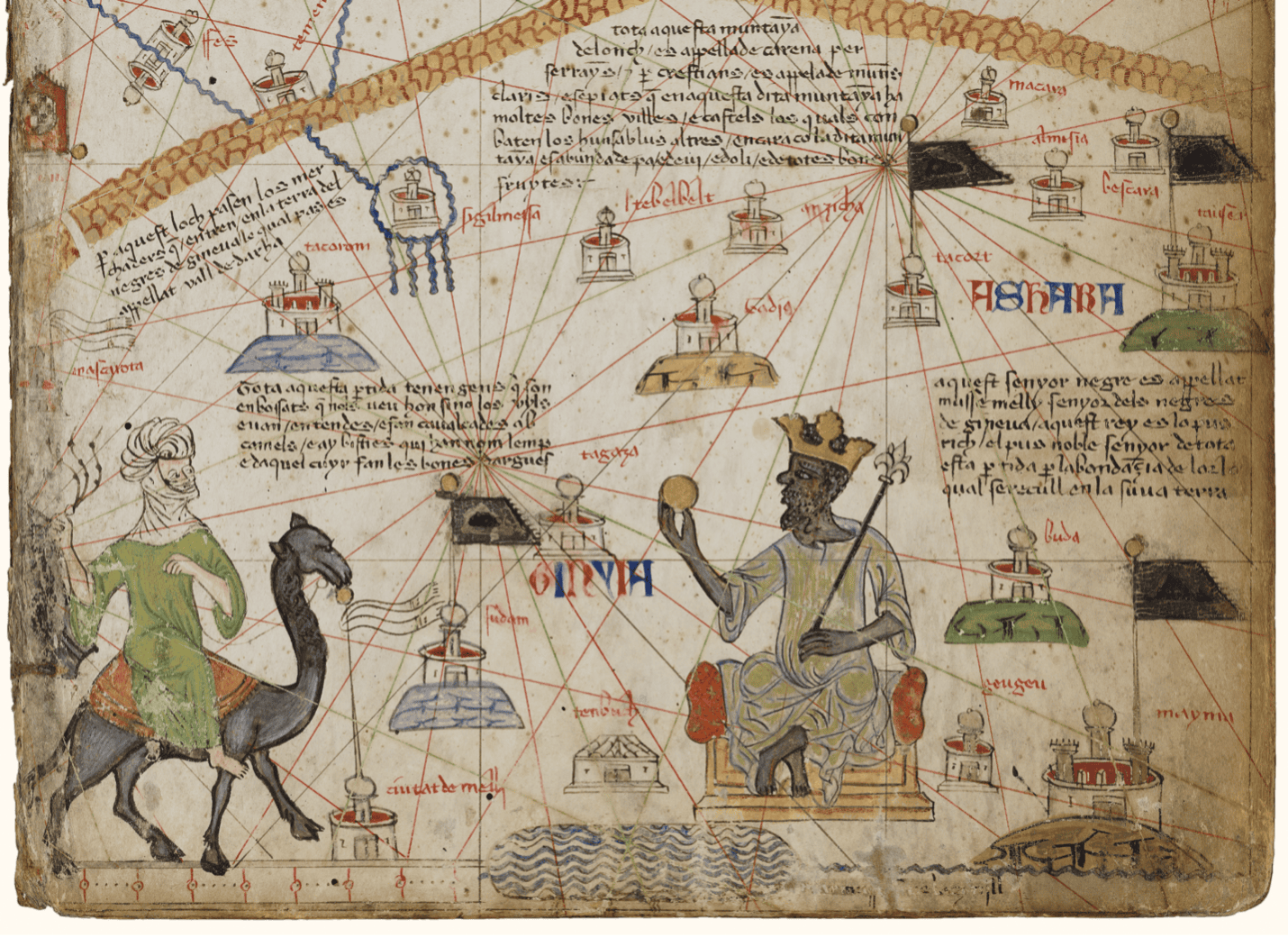

Travel and Trade in Later Medieval Africa

September 6, 2024

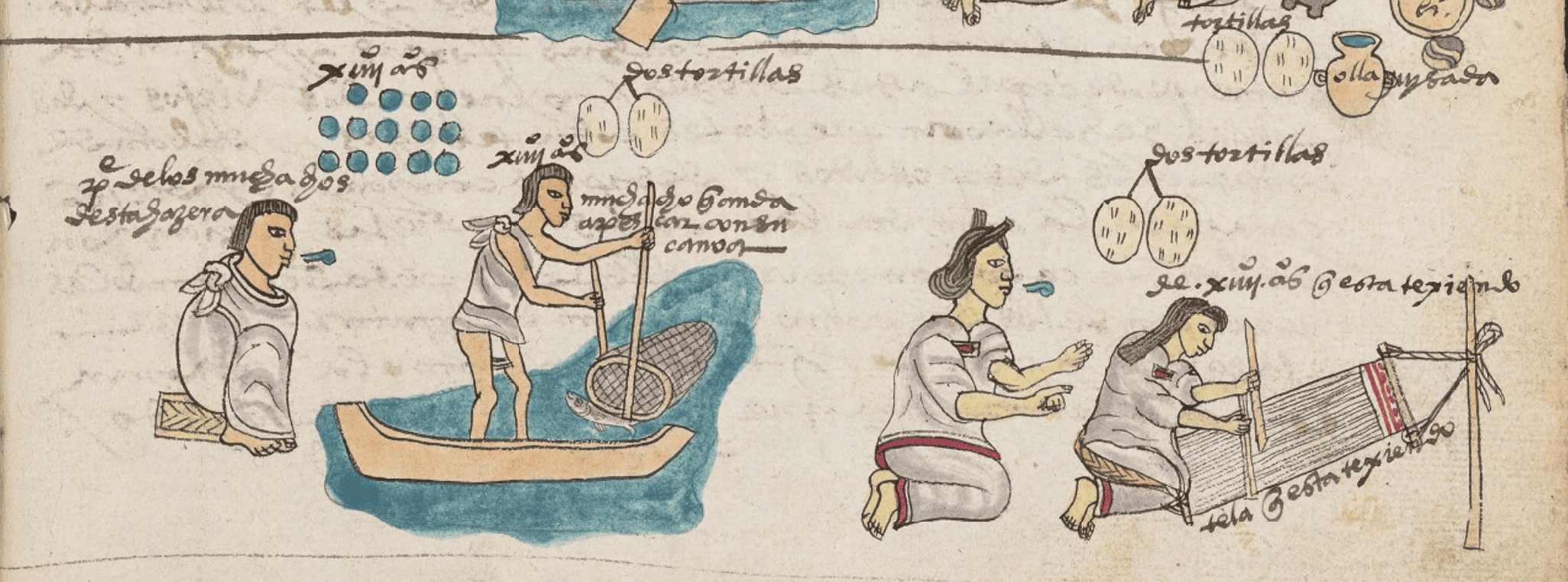

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024