From GI Roundtable 36: Does It Pay to Borrow? (1945)

That sounds simple. Most of us would answer that debt is owing money. Actually, however, it doesn’t have to be money. Suppose a farmer paid you in advance to plow a field for him the following week? You would owe him work, not money, but it would be a debt just the same. Or suppose you sold an antique chair from the attic for cash, and agreed to deliver it after you had fixed it up? Then you would owe a chair, not money.

Debt is created whenever one of the two parties to any transaction puts off turning over his end of the transaction—the money or the things or the work he is promising—but gets immediately the valuable consideration from the other party.

The other side of the picture

The opposite of debt is credit-and yet the two can never be separated. Credit is the Latin for “he believes.” The grantor of credit believes that the borrower will keep his promise to pay. Debt and credit are two faces of the same thing—deferred payments. The big difference is that debt is a liability to the man who owes it, but an asset to the creditor.

Can you get into debt without borrowing?

A minute’s thought will answer that one. There are a great many ways of getting into debt without borrowing. You might hire someone to fix your sidewalk. Then you would be in debt to him until you had paid him. Or you might have the bad luck to get into an automobile accident, and be held liable for damages. Or you might be hurt yourself, and have to have the doctor look after you. In that event you would owe him for his services until you paid him.

The city puts taxes on your home; the federal government puts a tax—the income tax—on your pay. Both of. these constitute debts until you pay them. You might subscribe to the Community Chest, promising to pay in quarterly installments. That, too, would be a debt. Or your, wife might get a divorce and the judge might grant her alimony. That would be still another kind of debt.

So you see that it is possible—most of us might say easy to get into debt unwillingly and unwittingly.

In many cases you cannot stop to weigh the advantages against the disadvantages and decide whether it would pay you to go into debt. Life is filled with the unexpected. The income and the expenses of most of us are subject to such changes that even the man who is a good manager may need luck to keep out of debt.

There are, however, certain guiding principles which the intelligent man should know and follow in managing his finances.

Related Resources

September 7, 2024

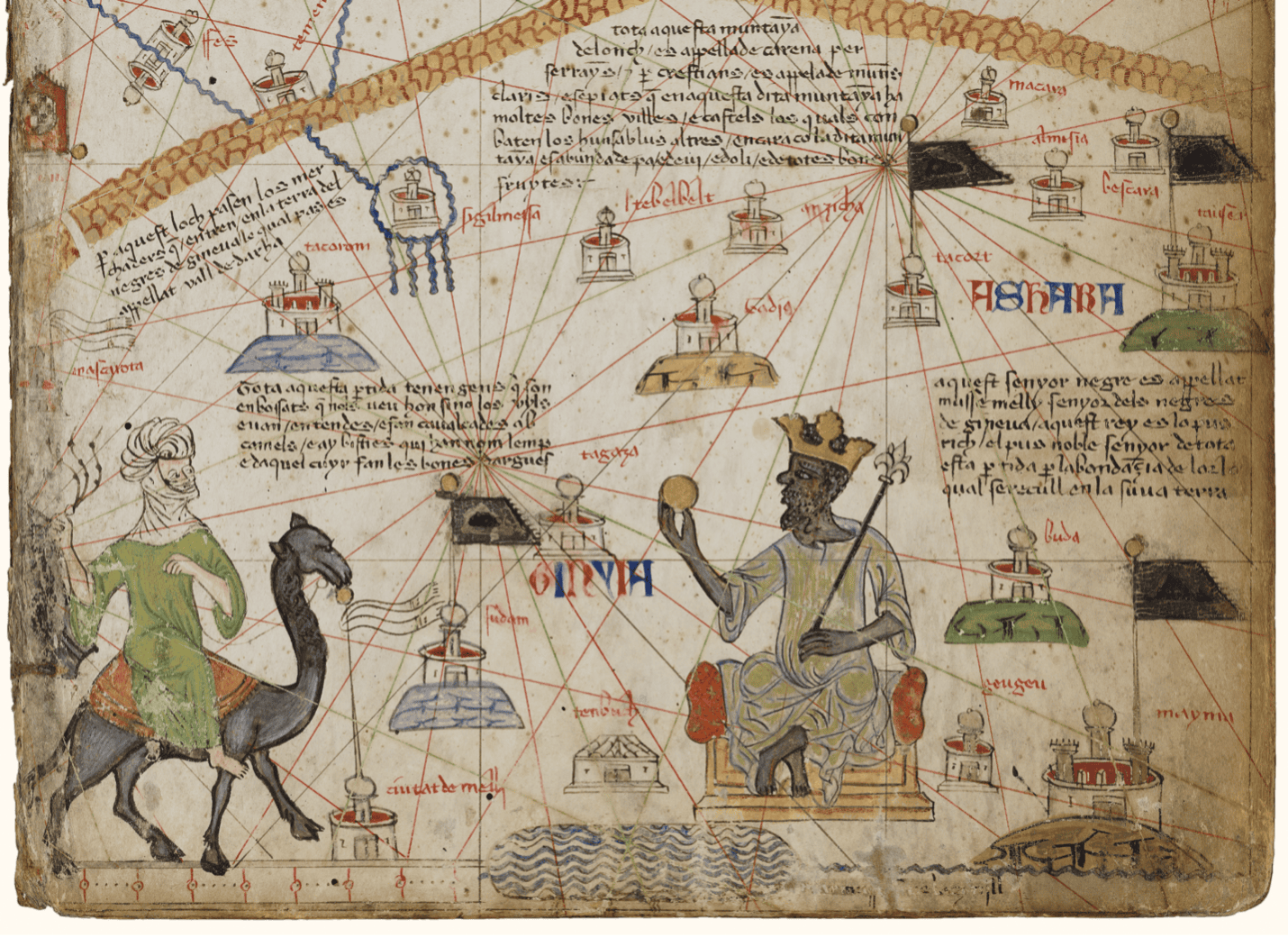

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024