From GI Roundtable 36: Does It Pay to Borrow? (1945)

The most common form of consumer credit is called by the economics professors “book credit.” Book credit is made up of the bills we run up at stores where we charge things, with the milkman, the filling station, or the tailor. It is largely a matter of convenience to the buyer. He does not have to carry so much cash in his pocket or write a check for every purchase. Instead, he wipes out the bill with a single payment at the end of the month.

But book credit is expensive to the seller. It requires book-keeping, billing, mailing, and collecting expense. There is a loss from bad debts. Considerable extra working capital is tied up in these accounts receivable.

To cover these costs of doing business, higher prices must be charged. Stores that do a strictly cash business usually sell things cheaper than those that offer credit. Is the added convenience worth the extra cost? That is a question every man must answer for himself.

How about the installment system?

Some businesses that sell on the installment plan have enough working capital to carry all or most of their accounts until they are paid. But many others do not. These can either borrow from a bank, by pledging the accounts receivable as collateral, or they can sell the note received from the debtor to a bank.

Or, if the seller does not do business on the installment plan, the buyer can go to a bank himself and borrow the amount of cash he needs for his purchase, arranging to pay back the loan on the installment basis.

Because the commercial banks were rather slow in developing this business, the finance companies, with which many of us have had experience, got their start. They finance the sale of automobiles, radios, furniture, stoves, sewing machines, jewelry, pianos, refrigerators, and other high-cost, long-lasting goods, on an installment basis. The seller of these goods turns over the notes signed by his customers and gets cash, and the customer then pays the finance company.

It is a universal rule in credit granting– that the lender does not want the borrower to default. He does not want to have the trouble and expense of a court action to repossess the article in question, and then of having to sell it again. Therefore the creditor will usually cooperate with the debtor if the latter has had misfortunes that make it impossible for him to make his payments on time.

Related Resources

September 7, 2024

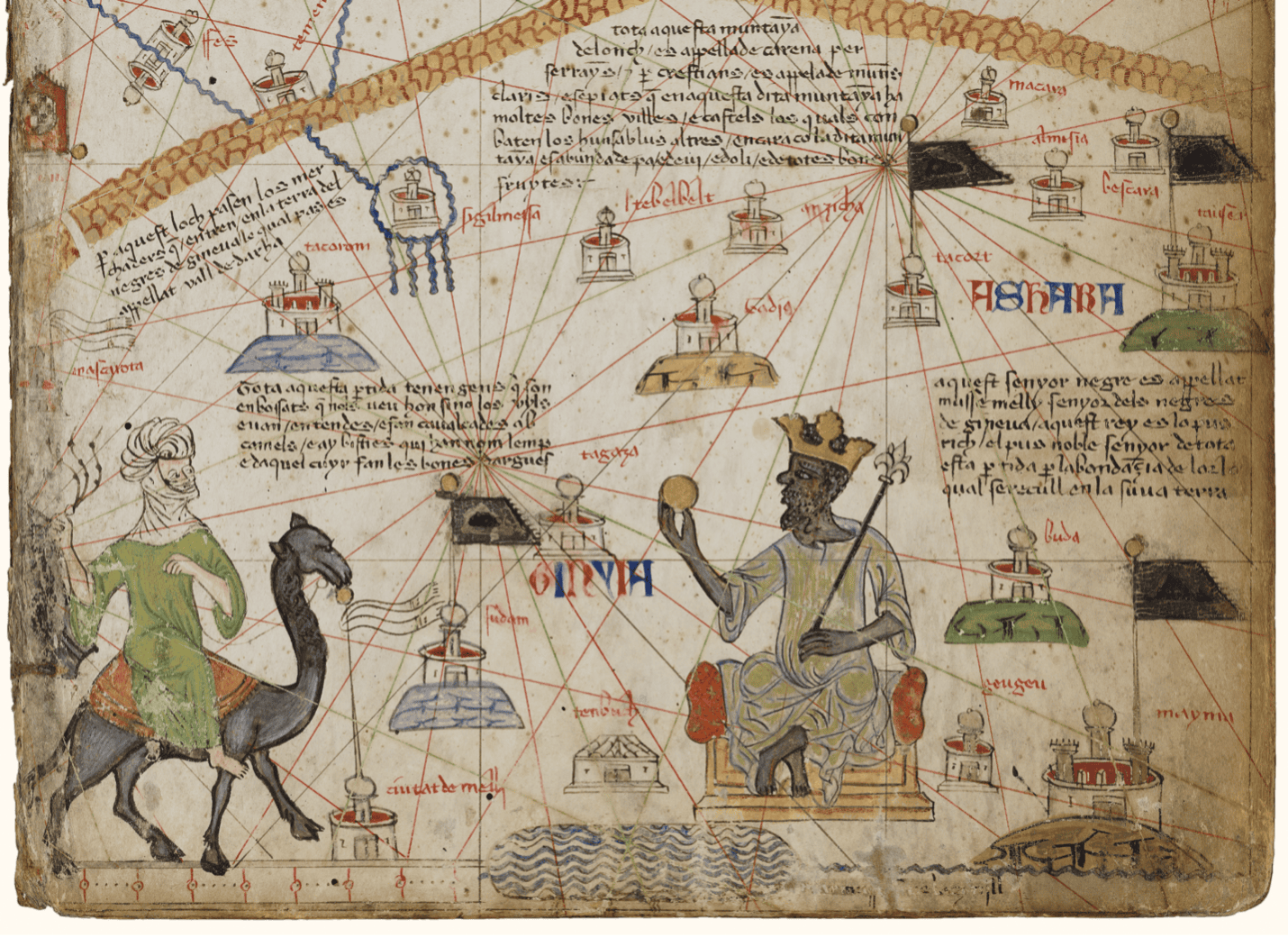

Travel and Trade in Later Medieval Africa

September 6, 2024

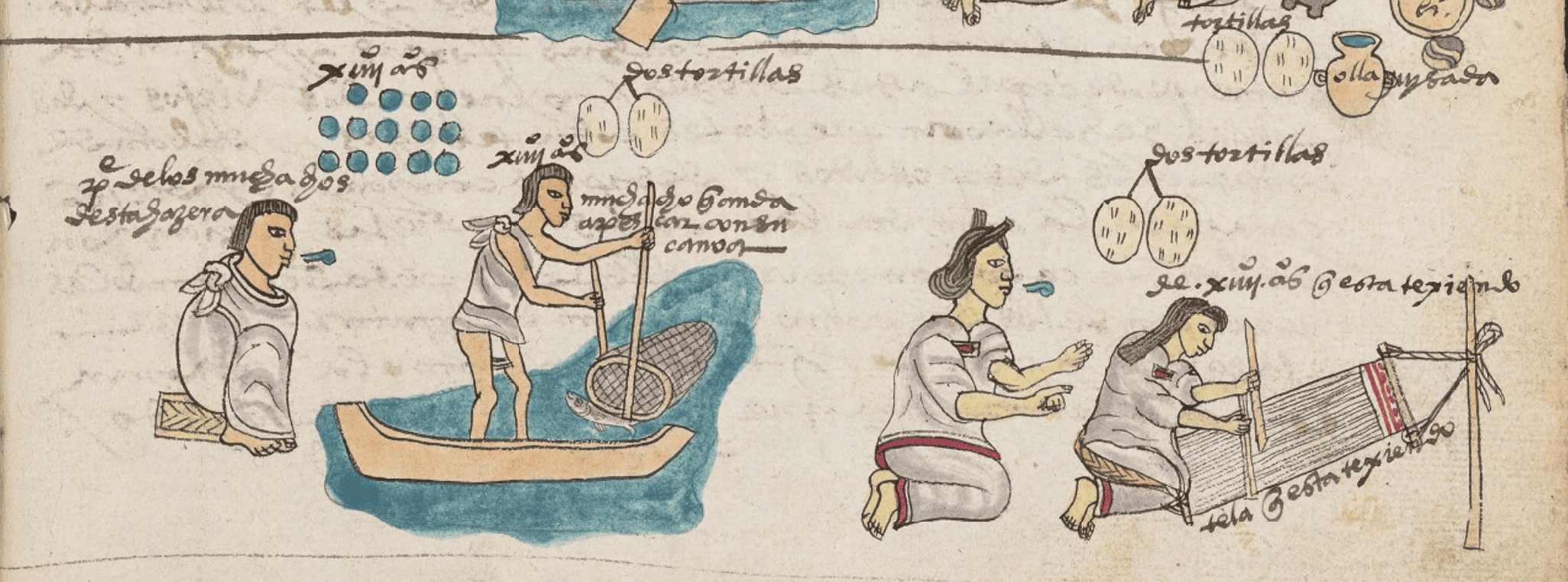

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024