From GI Roundtable 36: Does It Pay to Borrow? (1945)

If you don’t you’re lucky. Most of us have known that sinking feeling in the pit of the stomach that results from the unexpected and unforeseen need for a considerable amount of money. Hospital and doctor bills, for instance, or funeral expenses, or damage caused by a fire may create that need.

You may be able to borrow what you need from a friend, but more likely you will have to resort to a person or institution in the business of lending money. The most important of these are loan sharks, personal loan companies, the personal loan departments of commercial banks, life insurance companies in which you are a policyholder, and industrial banks.

Loan sharks

Loan sharks, who charge higher interest rates than the usury law allows, continue to thrive in spite of the efforts of the authorities to put them out of business and send them to jail. They have invented many ways of evading the law. Some of them take chattel mortgages on the furniture or other property of the borrower. Some take an assignment of his wages as security. Some buy his property at a ridiculously low price as part of an agreement under which he promises to buy it back at a much higher price.

Pity the man who falls into the clutches of a loan shark! He is likely to find himself getting ever deeper and deeper into debt until his plight is hopeless. The best thing he can do is go to the police or the district attorney with a frank statement of his difficulties.

Personal loan companies

Personal loan companies, which are privately owned and operated for profit, have arisen as the result of the so-called “Uniform Small Loan Law,” enacted in almost all states largely through the efforts of the Russell Sage Foundation.

After careful investigation, the Foundation concluded that the most effective way of combating usurious lending was to authorize an interest rate on small loans that would be sufficient to attract men of good character, with the needed capital, into the business.

The Uniform Small Loan Law regulates the business of lending sums under $300, at rates in excess of the legal contract rate. It requires that the lenders be licensed and supervised by the state; have a minimum capital of $25,000; be of good character; and charge an interest rate of not more than 3? per cent a month on unpaid balances only, not to be compounded.

The small-loan business cannot be conducted on the usual legal rates of interest. The expense of making these loans is high because each loan is small in amount; is made only after special investigation; is secured, if at all, by collateral that is hard to liquidate; and involves much bookkeeping and other expenses of collection.

The personal loan companies usually obtain their funds largely through the sale of common stock, on which they must pay adequate dividends. Therefore the loan rate must be high enough to cover not only their high operating costs, but also to provide dividends.

The rate of 3? per cent a month was recommended by the Russell Sage Foundation after experiments had shown that lower rates made the companies stop loaning such small sums as $25 and $50, thus throwing the poorer applicants back into the clutches of loan sharks.

However, the permitted rate of 3 per cent a month is actually 42 per cent a year.

Personal loan departments of banks

In recent years many commercial banks have opened small-loan departments. They usually follow much the same methods as the personal loan companies. But since they get their funds from demand deposits, which cost the banks very little, they can usually afford to lend at lower rates than the personal loan companies.

In some states the mutual savings banks, and in three states the savings and loan associations, have been authorized by law to make small loans. These institutions will also lend against a customer’s account book, on very easy terms. This is one of the best types of consumer loan since the borrower has a record of thrift. The loan will cost him little because his account continues to earn interest or dividends while the loan is outstanding.

Insurance policy loans

Life insurance policies customarily have a certain loan value, which is the amount that the company will lend the policy-holder at any time against the cash value of the policy. One of the commonest reasons for such borrowing is to avoid defaulting on a premium payment that is due. If the policy-holder desires to borrow over a considerable period, this may be the best way of doing so. But if the amount is small and he expects to pay it off in installments fairly soon, he may find that pledging the policy at a bank and borrowing against it is cheaper. But he may also find that it involves more red tape than borrowing from the insurance company.

In the First World War, the government began the practice of insuring the lives of the men in the armed forces. The holders of these policies were likewise able to borrow against them. When adjusted compensation certificates were later issued to veterans, their loan value, increasing each year up to maturity, was printed on them. Many holders of these certificates borrowed against them.

One year after National Service Life Insurance policies issued by the government in this war are converted into permanent policies, they begin to have loan value. As long as premiums are paid up, loans at 5 per cent interest and up to 94 per cent of the cash value may be obtained at any time. Veterans who need money badly should not overlook this cheap and ready source.

Industrial banks

The first “industrial” bank in this country, patterned on a European model, was established in 1910 by Arthur J. Morris of Norfolk, Virginia. The installment loan idea proved very successful. Morris Plan banks and other institutions of the same type that copied the basic idea now exist throughout the country

Since 1910 many Morris Plan banks have expanded their operations into other phases of banking. At the same time, many commercial banks have moved into the field of “indus-trial” banking by adding small-loan departments which operate in much the same way as Morris Plan institutions.

The distinctive features of the industrial bank on the Morris Plan are best described as they were originally established 35 years ago. At the start, Morris Plan banks did not accept pawns, chattel mortgages, or salary assignments as security for loans. In general they loaned to any responsible person of good character who could get two other responsible men to endorse his note. The borrower and the endorsers first had to establish their credit by filling out application blanks covering their character, financial record and responsibility, employment and income.

On approval of the application, all would sign a note running for a year. The borrower received the face value of the note, less interest at, say, 6 per cent and less an investigation fee of $1 for every $50 borrowed. As security for the note, the borrower had to pledge an “investment installment certificate” of the same amount as the face value of the note. He agreed to pay for this by a regular series of installments of equal amounts.

Some Morris Plan institutions still operate under the original system. But many have since greatly relaxed these rules in so many different ways that no general description can cover them all. By and large their operations- are little if any different from the industrial loan departments of commercial banks.

In their original form Morris Plan banks made loans only for useful purposes, such as to meet sudden expenses that developed from illness or misfortune or served to increase one’s earning power. Advocates of the Morris Plan claim that it promotes thrift, by training people in regular weekly payments; and that it preserves self-respect, for the loans are made at a reputable place, in a businesslike manner, and are based on character and habits.

Related Resources

September 7, 2024

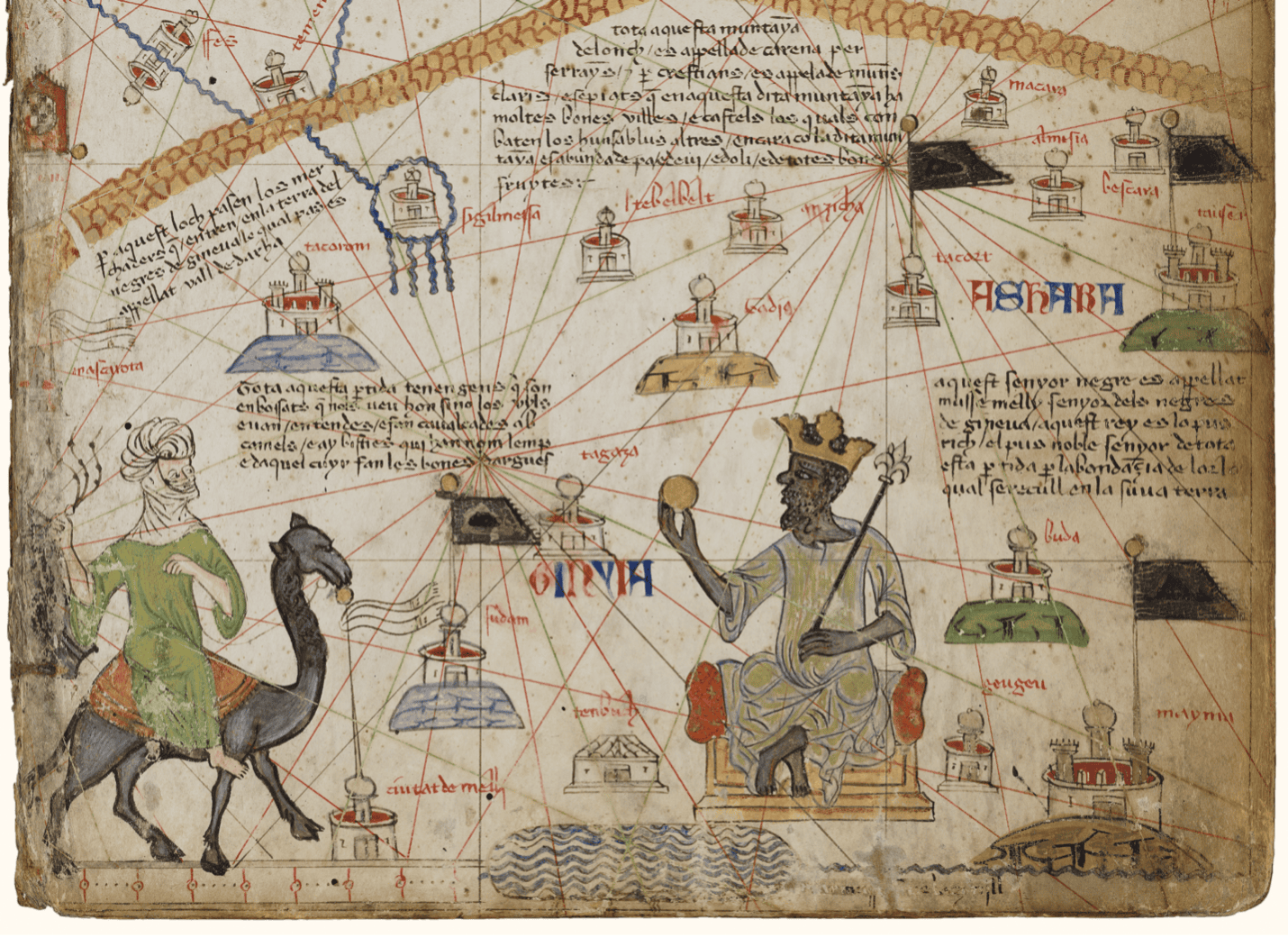

Travel and Trade in Later Medieval Africa

September 6, 2024

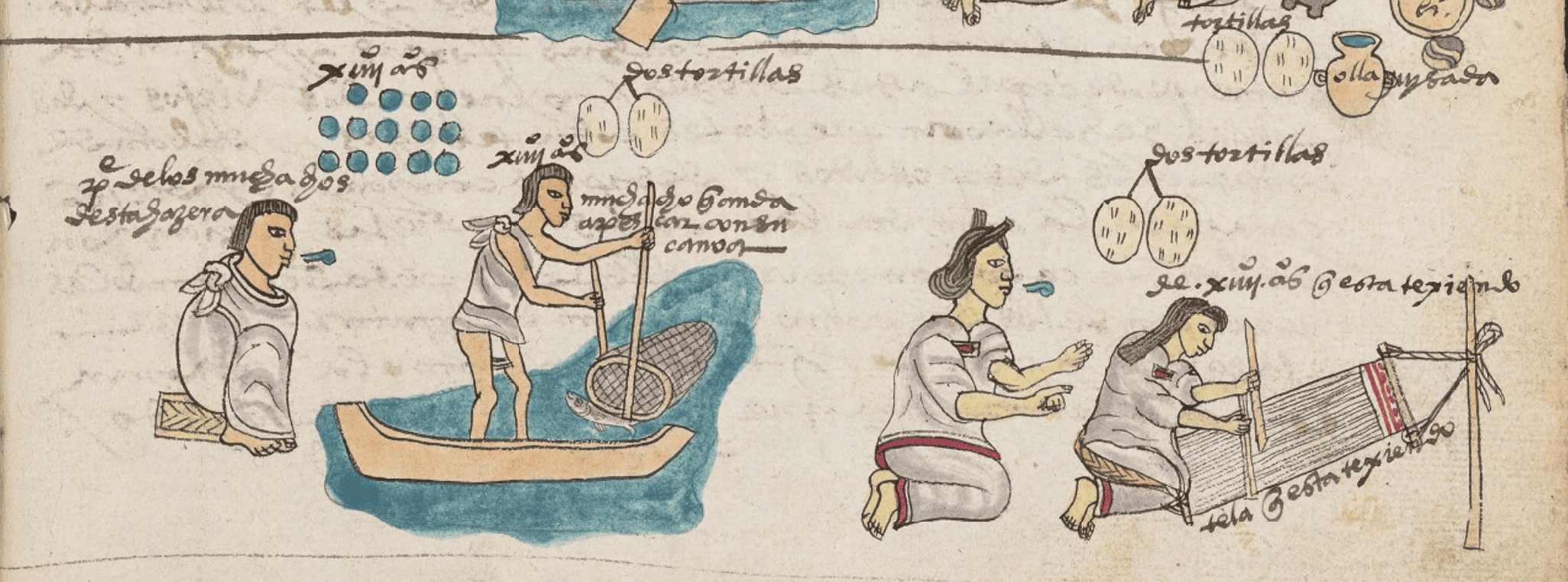

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024