From GI Roundtable 36: Does It Pay to Borrow? (1945)

The first of these principles is that there are heavy penalties for failing to pay one’s debts. This has been true from ancient times, when the way of the debtor was even harder than it is now. In those days the man who owed a debt he could not pay was held as a slave by his creditor, until he worked off the debt or it was paid for him by his friends.

In modern times imprisonment for debt has been abolished, and so the debtor need not fear being clapped into jail, unless he is guilty of fraud. But there are other penalties still existing. The creditor can sue the debtor who fails to pay, and get a judgment permitting him to seize the property of the debtor to make good the debt.

How about the bankruptcy laws?

It is true that the bankruptcy laws do give some protection to the man who owes more than he can possibly pay. If he can convince the courts that he cannot pay, then his assets, above a certain minimum which is exempt, will be divided among his creditors, and the man will be declared bankrupt, thereby voiding his debts and giving him a chance to make a fresh start.

But the blot on the financial record and reputation of a debtor who has defaulted will turn out to be a serious punishment to him.

He may think that only a few persons know about it, and that it will soon be forgotten. If so, he is likely to get an unpleasant surprise.

How does the word get about?

In every city there is a credit bureau which combs the records of the bankruptcy courts daily for information. The retail stores, the banks, the personal loan companies, the automobile dealers, and other businesses exchange information about customers who do not pay their bills. This too soon reaches the credit bureau.

Once a man gets a bad rating with the credit bureau, he will find that it is difficult for him to buy anything on credit or to borrow money. Even if he moves to another city his bad rating is likely to pursue him, for the credit bureaus of the various cities cooperate by exchanging information.

It may take a decade of hard work and thrift to live down such a bad reputation.

Do you want your own business?

A good financial reputation is absolutely essential to the man who hopes to have a business career. Have you ever known, a man who appeared to have all the qualities necessary for success, except that he couldn’t be trusted? Unfortunately, there are many such. It will not pay anyone who is ambitious for a business career to have unpaid debts, no matter what he gains otherwise, if by doing so he ruins his financial record.

Are good intentions legal tender?

Good intentions are not enough; the debtor must also have the means to pay.

Deliberately going into debt is something that should be done only after a great deal of thought and planning. That is especially true when a large sum is involved. The whole family should be convinced of the wisdom of the step, because every member may have to make sacrifices to keep up the payments.

How many kinds of debt are there?

It might be easy to wisecrack that there are two kinds of debt—good and bad. The economists who study these matters seriously agree that there are two kinds, but they classify them differently. They call them “consumer credit” and “producer credit,” depending on the use that is going to be made of the proceeds of the debt.

Related Resources

September 7, 2024

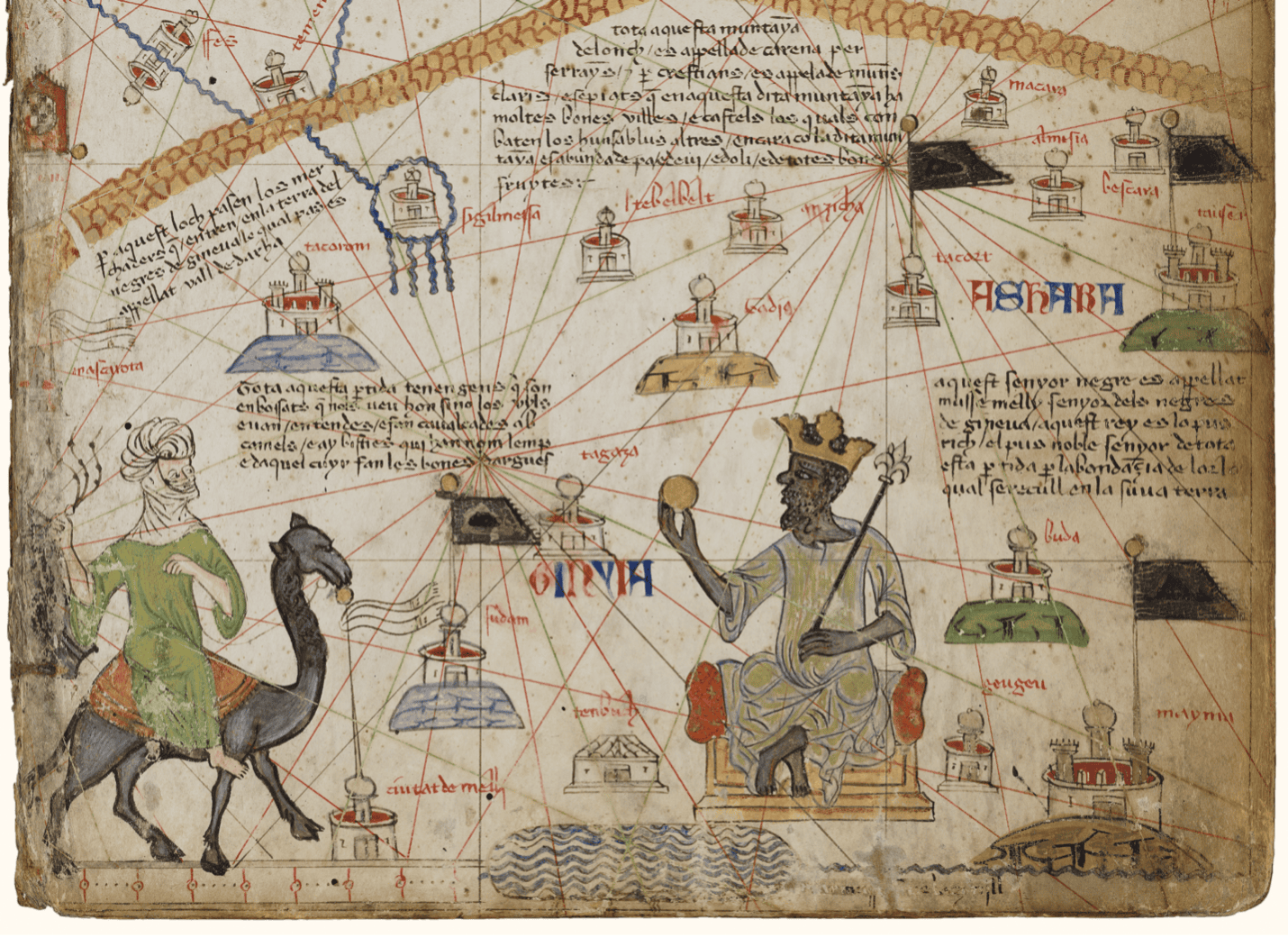

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024