From GI Roundtable 36: Does It Pay to Borrow? (1945)

A debt contracted for the purpose of increasing present consumption is called consumer credit. This is the only kind of debt that most ordinary persons ever contract.

People go into debt for all kinds of things—to buy food or clothing; to get a place to live; to travel; to go to football or baseball games; to bet on the horses; to contribute to worthy causes; to pay doctor bills.

You may think that some of these things are good and that others are bad, but the important consideration for us is that whether they are good or bad, they are not going to help us directly to pay back the debt. Good health helps to pay the doctor bills, in a way, and a well-dressed appearance may help to pay the tailor-particularly for a bond sales-man. But by and large, debts of this kind have to be paid back out of wealth or income that has not been increased by the debt.

What does consumer credit do?

Consumer credit advances the time of consumption, but not its amount. Over a long period of time no one can possibly get more automobiles, radios, dinners, theaters, or clothes by going into debt for them. He may have more of these things this month or this year by going into debt, but he will have to get along with fewer of them next year.

Indeed, consumer credit will eventually reduce the amount a man can enjoy, because part of the debtor’s income will have to go to pay the interest charges on his debt.

Is this an evil?

Are there some occasions when it is more important to advance the time of consumption than it is to wait for the time of maximum consumption? Most of us, on thinking it over, will undoubtedly say yes. For instance, thousands of men will go home to wives they married after they were in the service. Many of them will have to choose between buying furniture on the installment plan and setting up their own homes, or living in a furnished room, or with his or her parents. What would be your decision?

To take another example, parents might be warranted in going into debt to enable their children to get an education, since the education cannot be delayed if it is to be of value. The man who borrows to put himself through medical school almost certainly increases his ability to earn and pay off the debt. An individual who loves the piano might buy one on the installment plan, fully aware that the monthly payments will cut into his future purchasing power, but willing to make that sacrifice for the enjoyment he will get out of the instrument. For a music teacher, however, a debt of that kind would not be for consumption, but for production.

Is our standard of living supported on credit?

Consumer credit, although it cannot in the long run increase the total amount of goods sold, does have an important effect on what is sold. That is because consumer, credit is more readily advanced for certain kinds of goods than for others.

Would you expect to buy a house or a piano or a stove or an automobile on the installment plan? Most of us would say yes. Would you expect to buy groceries on the installment plan? That hardly needs an answer.

Installment selling started with things that cost more than ordinary purchases and lasted for a long time. The main reason for this was that the seller could protect himself against loss on such articles by taking them back if the buyer fell too far behind on his payments. Obviously this right wouldn’t be worth much if the goods had been consumed or had shrunk greatly in value.

As the installment system has become more and more popular, it has become possible to buy some things that are more quickly worn out, such as clothing, on the installment plan. One result of this development is that it is easier and easier to get into debt. It remains true, however, that installment selling is more commonly used for things that have a high cost and a long life.

You can’t buy a car and eat it, too:

Since installment credit does not increase the buyer’s income, and since most of it is granted for buying expensive long-lasting goods, the net result must be to cut down the amount of money that the buyer has available for such ordinary expenses of living as food and drink, amusements, and travel.

“Buy on Easy Terms. Take Nine Months To Pay,” say the ads on the billboards. It sounds so simple and so easy. And sometimes it is. But when you buy on the installment plan, do you always stop and realize that you are going to have to do without other things that you could otherwise enjoy?

Manufacturers of automobiles, radios, and many other high-cost goods often state that installment credit has done wonders in expanding their sales. That is true, but it has accomplished this by diverting expenditures from other things not sold on the installment plan.

It is also true, of course, that the larger sales of these high-cost goods have helped to bring about mass production, which in turn has greatly reduced the cost of these articles. Sometimes it is contended these price reductions more than offset the cost of the installment credit. What do you think? The economists claim it is impossible to prove this.

Related Resources

September 7, 2024

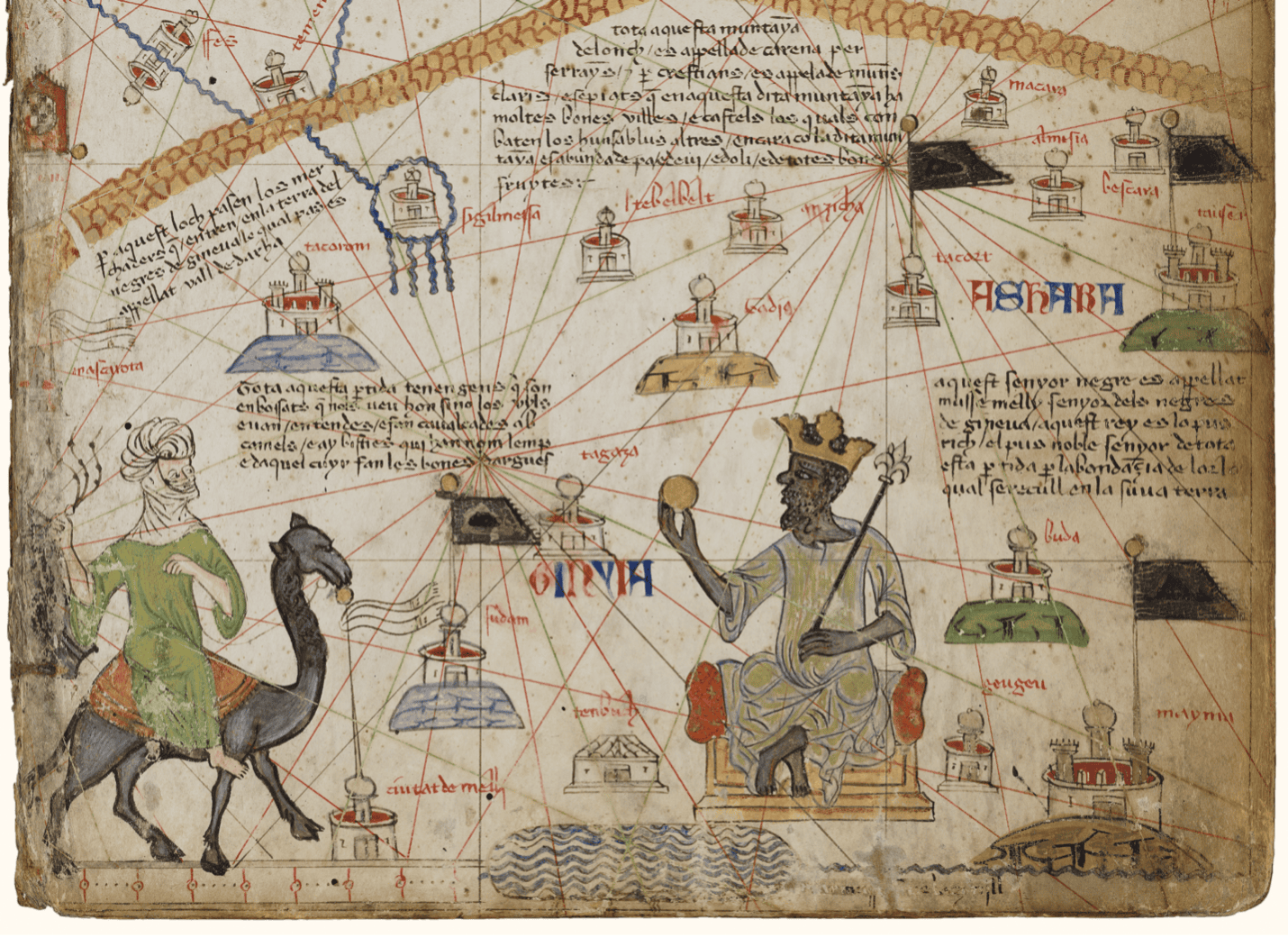

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024