From GI Roundtable 36: Does It Pay to Borrow? (1945)

Many men have more or less well-defined postwar plans that will require a sizable outlay of money-money they expect to borrow in one way or another. Some plan to buy a farm; others to establish a business; others to build, re-model, or re-equip a house. The Army-wide publicity given to the loan features of the GI Bill of Rights has led some men to give thought to financing personal projects which they might otherwise never have considered. Other men have got the idea that, because the government will guarantee GI loans, the ex-soldier’s obligation to pay up such loans will somehow be less than in the case of ordinary bank loans. Still others think that banks won’t worry about returning servicemen as credit risks, but that all such a man will have to do is to walk into a bank and ask for a government-guaranteed loan. So, through encouraging the discussion of the material in this pamphlet, you will be providing men with an opportunity to set themselves straight on an exceedingly practical subject.

Possible approaches

How can you help a group of men to work out a live discussion on a seemingly personal question like “Does it pay to borrow?” The answer is to select one or more common situations in which borrowing money is a factor, and to help the members of your group talk them out. If you can find an ex-banker or ex-credit man in your unit, have hire help you by sitting in to give expert technical information. It is also a good idea to make it possible for the men to read this pamphlet in advance. Put several copies in various key spots like the library, the service club, or day rooms. Finally, do not feel bound to use “Does it pay to borrow?” as your announced subject. Instead try to word your topic so that it will appeal to the specific interests of the men who attend your meetings. Here are two examples that may appeal to you: “Who should borrow money under the GI Bill of Rights?” or “Should a small business be started on borrowed money?” One of these topics or some other one that is tailored to the interests of your own group will bring a larger attendance to your meeting.

You, as the leader and organizer of an Army discussion group, are encouraged always to develop your meetings along lines that you know will enlist support from your particular group. All the suggestions given above, as well as the questions suggested below, should be accepted in this spirit. The same is true of the type of discussion meeting you hold-a forum, a panel discussion, or an informal discussion group.

Practical discussion materials

The techniques of various forms of discussion are outlined in EM 1, GI Roundtable: Guide for Discussion Leaders, which also gives advice on the promotion of discussion programs. If you plan to broadcast roundtable discussions on stations or sound systems of the Armed Forces Radio Service, you will find practical suggestions on radio discussion methods in ENT 90, GI Radio Roundtable. Other pamphlets already published in the GI Roundtable series arc listed at the back of this manual.

Questions for discussion

- Do you think that the loans provided by the GI Bill of Rights will help ease the transition from war to peace? Why do you think so? Under what circumstances should a man procure such a loan? I low do the benefits Of the GI Bill compare with these granted to the veterans of World War I? Of the Civil War?

- Would you undertake to start your own business on borrowed money if you saw a favorable opportunity? How would you decide whether the risk was worth taking?

- Do the advantages and convenience of installment buying outweigh its defects? Does the installment system encourage extravagant living?

- Is a farmer justified in going into debt to buy a new suit of clothes? Is a garage mechanic? An insurance salesman? Would each of these men be justified in borrowing the price of a suit of overalls?

- Why do department stores solicit charge accounts and even favor such customers over those who pay cash? Should they quote two prices, one for cash and the other for credit?

- Why can you usually get better terms for a loan if you make a large down payment than if you make a small one? Can you get a loan on better terms for the purchase of a new car than a used car? Why?

- From your own experience and observation, how do you think debt affects the character of the debtor? Would you draw a distinction here between what the pamphlet defines as “consumer credit” and “producer credit”? Where does casual borrowing from acquaintances or friends come into this question?

Suggestions for Further Reading

These books are suggested for supplementary reading if it so happens that you have access to them. They are not approved nor officially supplied by the War Department. They have been selected because they give additional information and represent different points of view.

A number of committees and foundations have issued pamphlets which cover the fields of personal loans, borrowing, debt, credit, loan sharks, and so forth. Some of these make good supplementary reading to this pamphlet. The following are suggested:

Loan Sharks and Their Victims. By William T. Foster (1944).

Credit for Consumers. By LeBaron R. Foster (1942).

Credit Unions—The People’s Banks. By Maxwell S. Stewart (1942).

Instalment Selling—Pros And Cons. By William T. Foster (1941).

The above four pamphlets are all published by Public Affairs Committee, 30 Rockefeller Plaza, New York, N. Y.

Painless Debtistry. By William T. Foster (1933). Reprinted from North American Review, June 1933.

Public Supervision of Consumer Credit. By William T. Foster (1939).

Small Loan Laws of the United States (1943).

Consumer Loans by Commercial Banks. By William T. Foster (1940).

The above four pamphlets are all published by Pollak Foundation for Economic Research, Newton, Mass.

Facts Veterans Should Know before Starting a Business (1944).

Facts You Should Know about Borrowing (1937).

The above two pamphlets, and others on related subjects, may be obtained either from the National Association of Better Business Bureaus, 212 Cuyahoga Building, Cleveland, Ohio, or from the nearest local Better Business Bureau.

The Pros and Cons of Consumer Credit. By Constance Kent. Published by Workers Education Bureau Press, 1440 Broadway, New York, N. Y. (1941).

“Consumer Credit.” A series of articles in Annals of the American Academy of Political and Social Science, March 1938.

The following books may prove useful:

Financing the Consumer. By Evans Clark. Published by Harper and Brothers, 49 East 33d St., New York 16, N. Y. (1930).

Consumer Credit and its Uses. By Charles O. Hardy. Published by Prentice-Hall, 70 Fifth Ave., New York 11, N. Y. (1938).

Term Lending to Business. By Neil H. Jacoby and Raymond J, Saulnier. Published by National Bureau of Economic Research, 1819 Broadway, New York 23, N. Y. (1942).

Related Resources

September 7, 2024

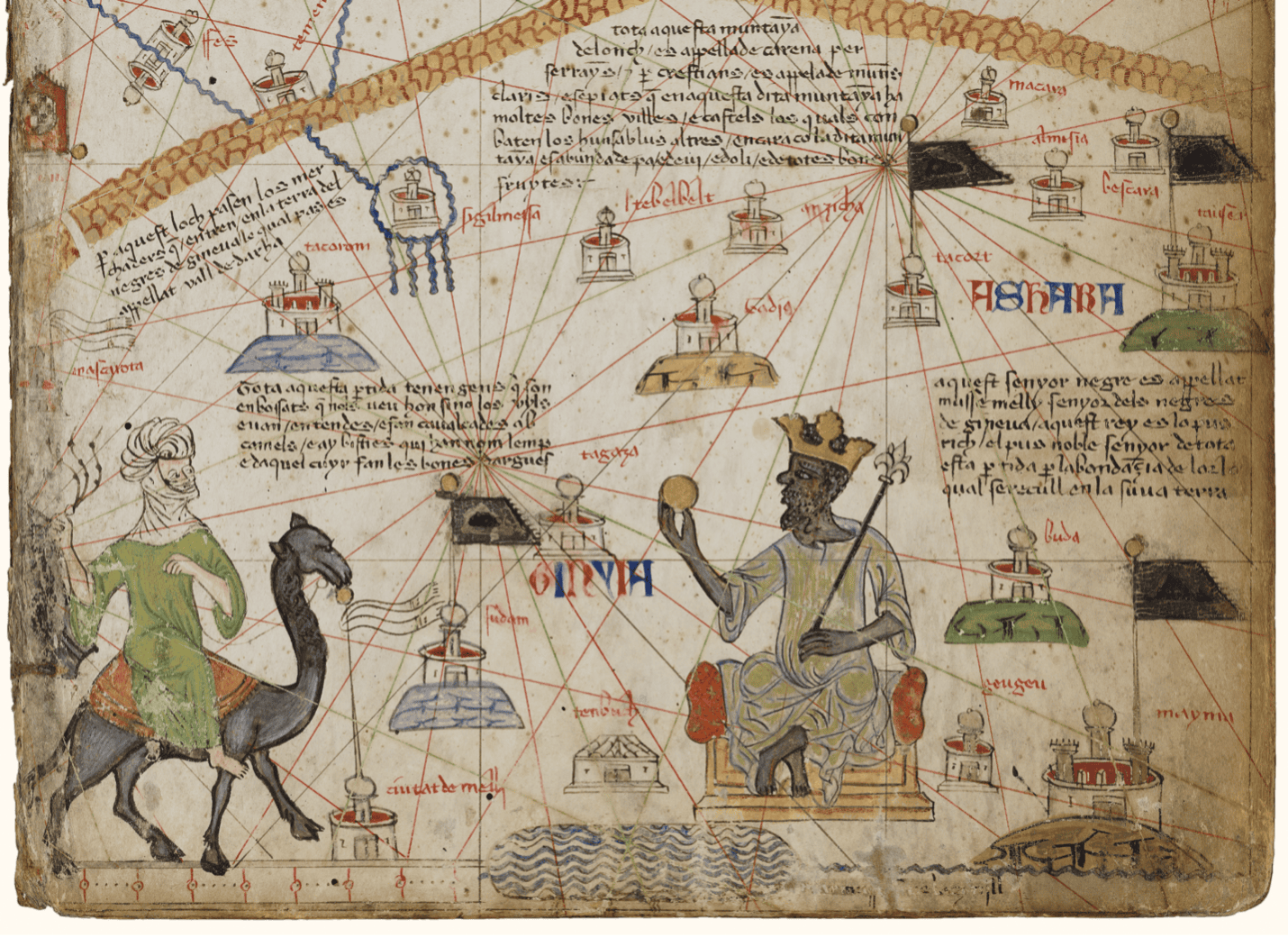

Travel and Trade in Later Medieval Africa

September 6, 2024

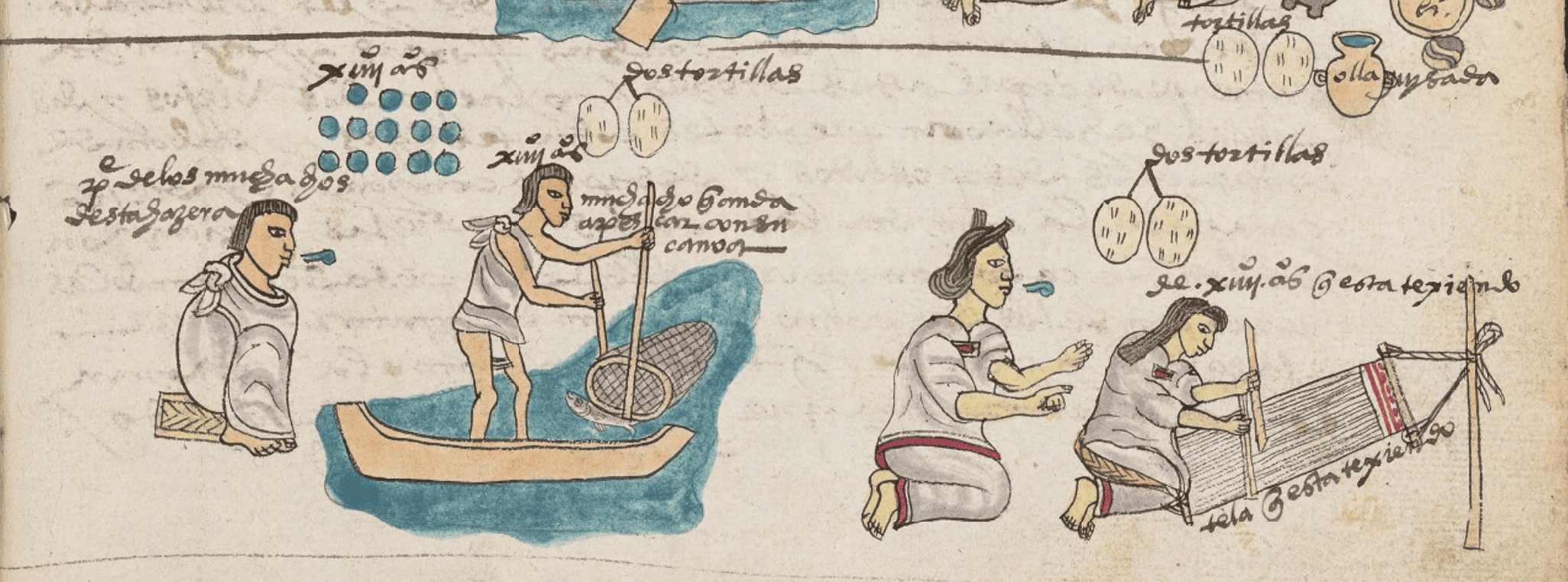

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024