From GI Roundtable 36: Does It Pay to Borrow? (1945)

Probably every man in the Army has heard about the GI Bill of Rights, as the Servicemen’s Readjustment Act of 1944 is popularly known. This law has fifteen “chapters” grouped under six major “titles.” Title III, the only one that directly concerns the topic of borrowing, provides for “Loans for the Purchase or Construction of Homes, Farms and Business Property.”

Who is eligible?

Any veteran who served in the active military or naval service of the United States between September 16, 1940 and the end of the war, and was discharged or released under conditions other than dishonorable after having served ninety days or more, or by reason of an injury or disability incurred in the line of duty, will be eligible for federal guaranty of a loan to him.

How does he get it?

Any such veteran may apply within two years after his separation from the military or naval forces, or two years after termination of the war (whichever is the later date) but in no event more than five years after the war ends. He may ask the Administrator of Veterans Affairs for the guaranty of not more than half of a loan or a series of loans for various designated purposes. The total amount guaranteed must not exceed $2,000. If the administrator finds the veteran is eligible, and the loan appears practicable, he must make the guaranty.

What are the terms of the loan?

The law provides that loans guaranteed by the administrator are to be made payable under such terms and conditions as may be established by him. The law stipulates, however, that the interest rate shall not be more than 4 per cent a year and that the loan shall be payable in full within twenty years. No security for the guaranty of the loan will be required of the borrower. Interest for the first year on the guaranteed part of the loan will be paid by the administrator.

Such agencies of the federal government as the Farm Credit Administration and the Federal Housing Agency are authorized to loan money or to guarantee or insure loans to citizens for some of the same purposes as are covered in the GI Bill. Suppose a veteran gets a loan from one of these agencies to cover part of the cost of building a house or buying a farm or whatever he wants to do. Under the GI Bill he may still be able to get a guaranty from the Veterans Administration of the entire amount of a second loan. However, the total amount guaranteed may not exceed $2,000, and the second loan may not be for more than 20 per cent of the purchase price or cost of his home or farm.

In the case of a mortgage, the mortgagor and mortgagee must agree that, before beginning foreclosure proceedings for default of payments of principal or interest due, the administrator will be given at least thirty days’ notice, with the option of bidding in the property on foreclosure or of refinancing the loan with another lending agency.

This probably means that every effort will be made to save for the veteran his equity in the property.

Where does the veteran get a loan?

Don’t make the mistake of thinking that loans under the GI Bill are a new kind of government handout to veterans. They are not gifts of $2,000 per veteran—or anything of the kind. They are business transactions in which a veteran borrows a sum of money-usually from a private lender—and obligates himself to pay it back with interest.

The Veterans Administration does not loan money, nor does it say how much a veteran can borrow or from whom. Like anyone else, veterans can borrow money as long as they can find somebody to lend it to them. What the government does under the GI Bill is simply to guarantee the lender against loss of 50 per cent, or up to $2,000, of certain kinds of loans.

The lender may be a person, a firm, an association, a corporation, or a governmental agency or corporation, either state or federal. The veteran, therefore, can go to anyone who wants to lend him money and together with the lender make application to the Administrator of Veterans Affairs for a loan guaranty. It’s always a good idea, of course, to deal with a reputable person or firm. Incidentally, no brokerage or other charge can be made for “helping” a veteran get a loan guaranty.

Related Resources

September 7, 2024

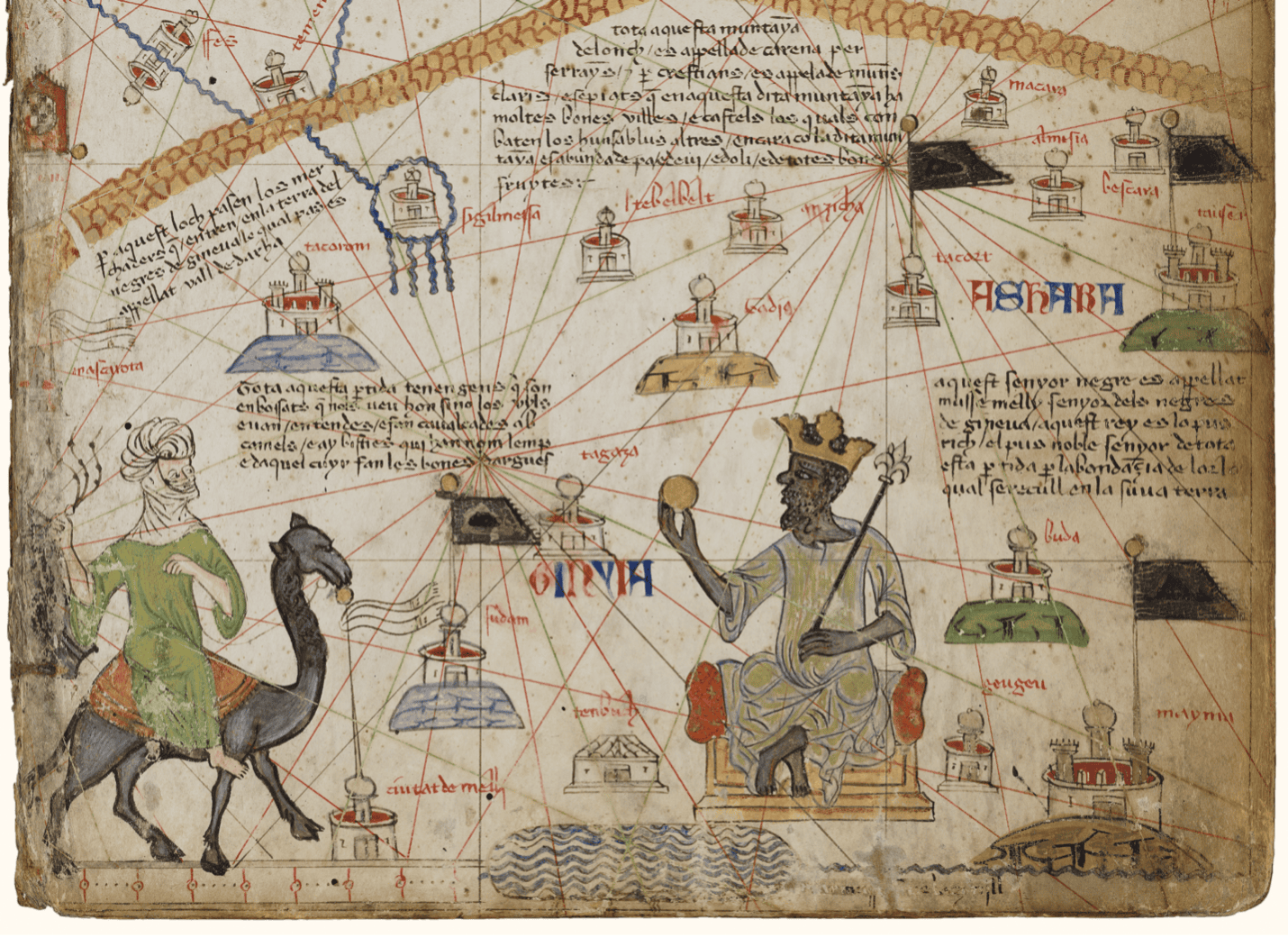

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024