From GI Roundtable 5: Why Do We Have a Social Security Law? (1946)

Millions of servicemen, veterans, and former war workers are asking a big question: “What about jobs?”

To employ every person who wants to work and is able to work in postwar America, we must produce—and sell—30 to perhaps 50 percent more goods than we produced in 1940. Can we do this?

“Of course,” you say. “That’s easy. We can all use more goods, better homes, better food, more clothes, more travel, a higher standard of living.”

But is it so easy? We could all have used more goods in 1940, too. Yet we didn’t produce them. Why? Not for lack of factories—many plants were idle. Not for lack of capital—there was plenty of money waiting to be invested. Not for lack of workers—there were 8 or 9 million workers looking for jobs.

The reason we didn’t use that capital and those workers to produce more goods in those factories was because there wasn’t a big enough market. The people who wanted the goods didn’t have the money to buy them.

Now that the war is over and war production has stopped, we are facing the same problem again. During the war, factory ay rolls were over three times as high as they were in 1940. The Army and Navy and other government agencies bought half our products and paid for many of them on credit. Can employers step in and keep up such a pay roll? If they do, can they sell their products to you and me, and to the rest of the world, at a profit?

It’s a big question, all right. So big that businessmen, labor unions, government officials, and leaders in the community and the nation are busy trying to work out a satisfactory answer.

The second big question—“security”

The next big question most of us are asking ourselves these days is: “What about security for myself and my family?”

The answer to this question is that security for all of us lies in some kind of system that in good times, when all or most of us are employed, will help us accumulate credits to tide us over bad times, when a lot of us are old or without jobs. This is the philosophy behind social insurance.

“Let’s leave it to the individual!”

Some people say, “Let’s leave the job of saving for periods of unemployment to the individual.” This worked once—before World War I.

But even in the prosperous 1920’s, when wages rose rapidly, unemployment rose rapidly, too. In spite of higher wages, workers lost their jobs, their savings, their homes. Higher wages did not provide security. Farmers lost their farms through foreclosure—five times as rapidly in the 1920’s as in the previous ten years. Bank failures were four times as high, and business failures considerably higher. Even in the “prosperous” 1920’s the kind of prosperity we had was not enough to give everybody security.

“Let’s leave it to the employer!”

Other people say, “Let’s leave the job of providing security for his employees to the employer.” But in a system where one employer competes against another—as in our system of private enterprise—every employer is an employee, too. That is, he is employed by the community to furnish his neighbors with goods and services. He has no assurance that the community will keep him continuously employed—keep him in business. He is dependent on the market.

If a maker of shoes, for instance, works out a way to produce the same number of shoes with half as many workers, he cannot be expected to keep the other half of his workers employed. The job of looking after these workers becomes somebody else’s—somebody producing other kinds of clothing, or food, or services. No employer can provide security for former employees if he expects to remain in business.

“Let’s leave it to the government!”

Quite a lot of people unwilling to put the burden of security on the individual worker or employer say, “Let the government do it!” Well, the government has tried. In the 1930’s, the government loaned money to business to keep it going, paid subsidies to farmers to keep them on the land, and paid wages to the unemployed for work so that they could continue to eat and pay rent. The government loaned, invested, and spent outright billions in what was called “deficit financing.”

Government spending caused employment and incomes to increase. But when we reduced this spending in 1937 we had a recession. So deficit spending is not a cure-all nor a solution for normal times. It didn’t prevent our having 8 to 9 million unemployed in 1940. It didn’t put business back on a sound basis.

Everybody’s business

If employers, workers, or the government can’t solve the problem of social security alone, then it is nobody’s concern—or everybody’s. Under the Social Security Act, security is everybody’s concern—the federal government’s, state and local governments’, employers’, workers’. All these agencies and people cooperate to guarantee to the individual worker the needed protection against loss of income, while still leaving worker and employer free to make any personal adjustments his job or his business require. Social security spreads the risk over the whole community, instead of letting it fall on certain individuals.

Related Resources

September 7, 2024

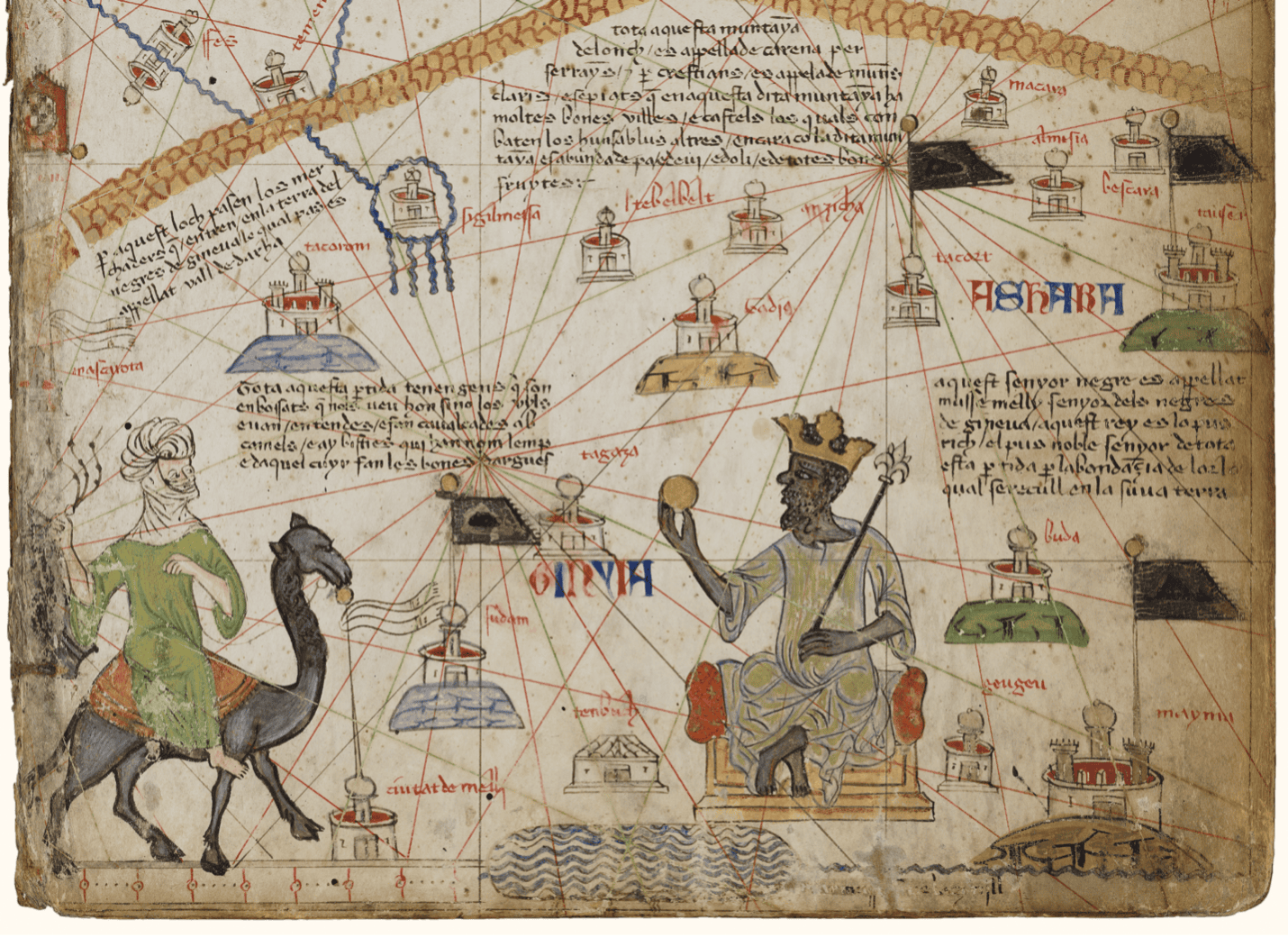

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024