From GI Roundtable 5: Why Do We Have a Social Security Law? (1946)

Social security alone can’t solve postwar problems of employment. Only jobs can do that.

Social security doesn’t free the individual from the opportunity—and the duty—of working, of finding the best possible job for himself at his highest skill, of saving money, of taking out insurance, of doing all the other foresighted things to gain more individual security for himself and his family.

How social insurance works

Social insurance is so new in this country that many people are not sure exactly how it works. Actually, the principle is simple. It is the same principle used in life insurance or fire insurance—spreading the risk. In the words of Winston Churchill, “It brings the magic of averages to the rescue of the millions.”

Disaster—loss of a job, loss of the breadwinning head of a family—may strike any of us at any time. Actually, it doesn’t strike all of us at any given time. If the government collects a small premium from the millions who are exposed to these risks, a fund can be built up to pay benefits to those who are suffering at the moment.

There is one important distinction between social and private insurance. In the case of private insurance, the policyholder does all the paying for the protection he gets. In the case of social insurance, the policyholder does not pay all or, in some cases, any of the premiums. In the case of unemployment insurance, in most states the employer pays the entire premium. In the case of old-age and survivors insurance, the employer and the employee share the cost.

Unemployment insurance helps the worker, of course. But it also helps the community. Here is an example. A factory with a war contract had to lay off over a hundred workers temporarily when its contract was canceled. Because the factory was a small one, reconverting it took only a few weeks. But during this reconversion period, if the workers had not received unemployment payments, many would have had to move away. Meanwhile, the grocer, the butcher, the power and gas companies would have lost part of their income. Then when the factory was ready to operate at full force again, it would have had the difficult and expensive job of training new workers. Unemployment insurance helped the community during reconversion from wartime to peacetime.

The Social Security Act

The federal Social Security Act was passed by the Congress in August 1935 by a large majority—76 to 7 in the Senate, and 371 to 33 in the House of Representatives. The act created a Social Security Board to administer the system. This board consisted of three members appointed by the president for six-year terms.

On May 24, 1937, the United States Supreme Court upheld the essential features of the social security program. Up to this time, many opponents of federally administered social security had said that the act was unconstitutional because it took away from the states, from private business, and from private individuals rights given them by our Constitution and handed these rights over to the federal government.

Our federal social security program falls into three main parts—public assistance, old-age and survivors insurance, and unemployment compensation.

Public assistance—what it does

Public assistance helps the states care for needy persons over 65, needy blind persons, and certain dependent children. The federal government meets half the cost, up to specified amounts, but the program is run by the states.

Payments are based on the individual’s need and take into account any other income and resources he may have. Most people receiving public assistance are unemployable—that is, they cannot hold jobs and, except in the case of children and some others, they will never be able to get jobs.

Those receiving public assistance payments today average 75 years of age. But gradually, as time goes on, more and more old people and children will come under another part of the social security program—old-age and survivors insurance. Then, payments based on need may not be quite so necessary for most old workers and dependent children.

Public assistance—what it doesn’t do

The kind of public assistance provided under the Social Security Act applies only to certain groups of people. It is available for those who are over 65, for those who are blind, and for needy dependent children one or both of whose parents are away, dead, or unable to work. Also, to be eligible, the children must be under 18, must be going to school if between 16 and 18, and must be living at home or with a close relative.

Up to certain limits, the federal government will match, dollar for dollar, what the states spend for public assistance to these groups. Therefore, federal expenditures available to a state can never be more and may be less than what the state itself is willing to put out. No federal funds are available to aid individuals who do not come under the specified programs. In most states, funds for general assistance to such individuals are inadequate in comparison with those for the special types.

Under this program the federal government is spending about six times as much on old people as on children—despite the fact that in the whole country there are about four times as many children under 18 as there are adults over 65.

Public Assistance (June 1945)

Old-Age Assistance

Number of recipients 2,038,000

Average payment $29.46

Aid to Dependent Children

Number of families 255,674

Number of children 646,801

Average payment per family $47.46

Aid to the Blind

Number of recipients 55,465

Average payments $30.27

Old-age and survivors insurance—what it does

This is the only one of the three social security programs which is operated directly and exclusively by the federal government. When a worker retires, old-age and survivors insurance pays him monthly benefits with an additional allowance for his wife if she is 65 or over. If he dies, benefits are provided for his widow if she is 65 or over. If she has children under the age of 18 she gets benefits regardless of her age. Additional benefits are provided for the children.

Benefits are based on past earnings. Costs are met by payroll taxes contributed equally by workers and employers. The average monthly benefit for a single worker now is something over $23. For a man and wife it is about $38 a month, and for a surviving widow with two children about $47 a month. This isn’t much, but it is more than the average old person had in the past, and it is in addition to any savings or insurance or other property which he may have.

Who Gets Old-Age and Survivors Insurance?

As of July 1945

| Class | Number of beneficiaries | Percent |

|---|---|---|

| Retired workers, aged 65 or over | 519,000 | 40% |

| Wives, 65 or over, of retired workers | 154,000 | 12% |

| Widows with young children | 145,000 | 11% |

| Children of deceased or retired workers | 378,000 | 29% |

| Aged widows of deceased workers (65 or over) | 83,000 | 7% |

| Aged dependent parents (65 or over) of deceased worker who left no widow or child under 18 | 6,000 | 1% |

| Total | 1,285,000 |

Old-age and survivors insurance—what it doesn’t do

This form of insurance does not yet cover farm workers, domestic servants, government employees, employees of nonprofit institutions such as churches, schools, and hospitals, or the self-employed. Some of these groups, of course, have their own systems of retirement benefits.

Unemployment insurance—what it does

The unemployment insurance system is operated by the states. The federal government pays only the costs of administration—all other costs are met by a tax on pay rolls paid by the employer; the worker in most states contributes nothing.

If a worker has been working a certain length of time in a job covered by the law, and if he then loses his job and remains unemployed under certain conditions, he is entitled to weekly unemployment benefits.

Unemployment insurance—what it doesn’t do

In many states, unemployment insurance does not provide enough money for the worker to live on. In some cases benefits are less than one-fourth his normal wages. Except in a few states, there is no additional allowance for dependents, as in old-age and survivors insurance. Benefits can be drawn only for a limited time.

Even in good times, approximately half the workers who drew benefits were still unemployed when their benefit rights were used up. Economists estimate that only about 10 cents on the dollar lost by all workers through unemployment, and 20 cents to 25 cents by covered workers, are made up by unemployment benefits. Of course, unemployment benefits are not intended to approximate wages.

Related Resources

September 7, 2024

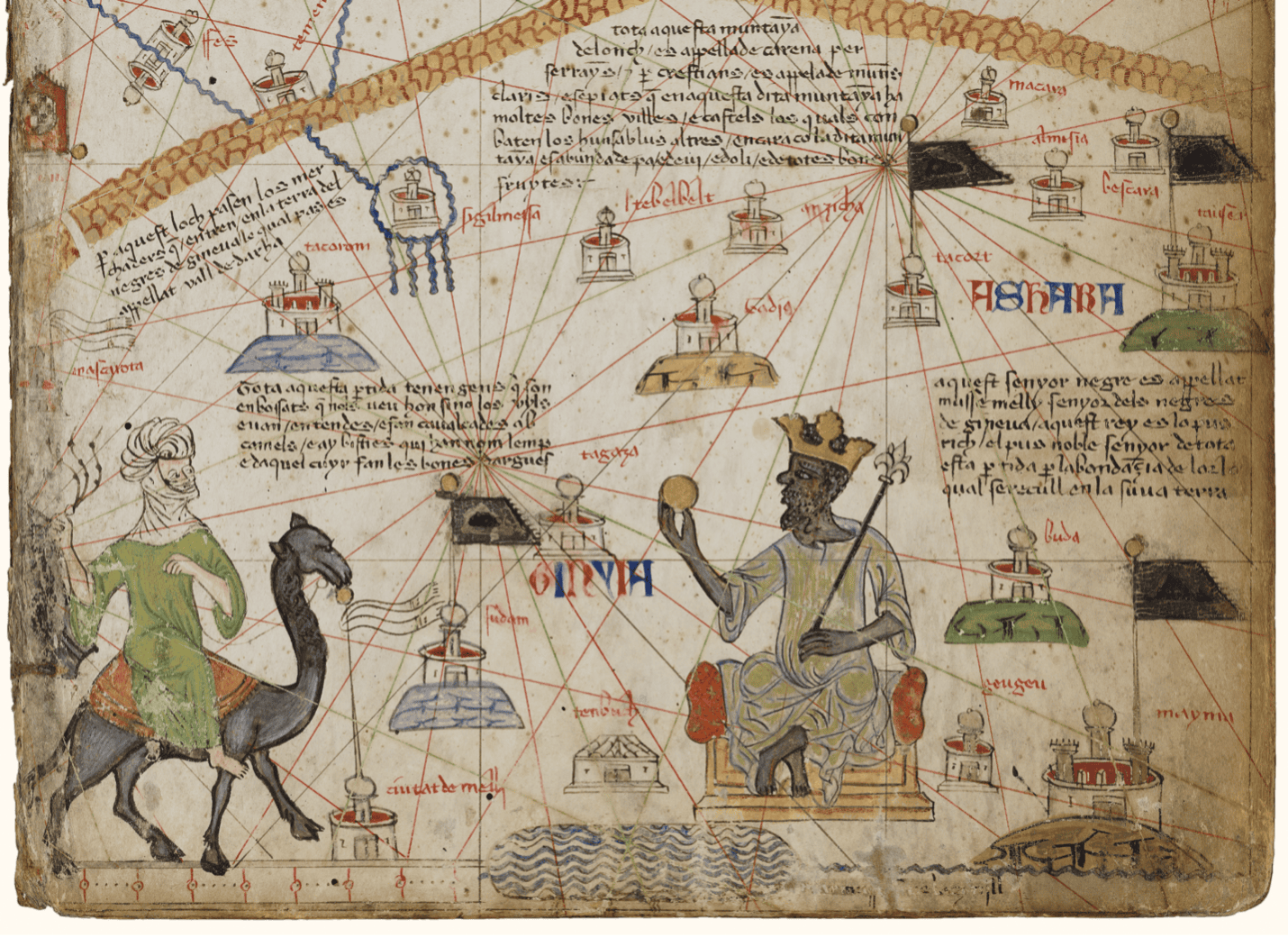

Travel and Trade in Later Medieval Africa

September 6, 2024

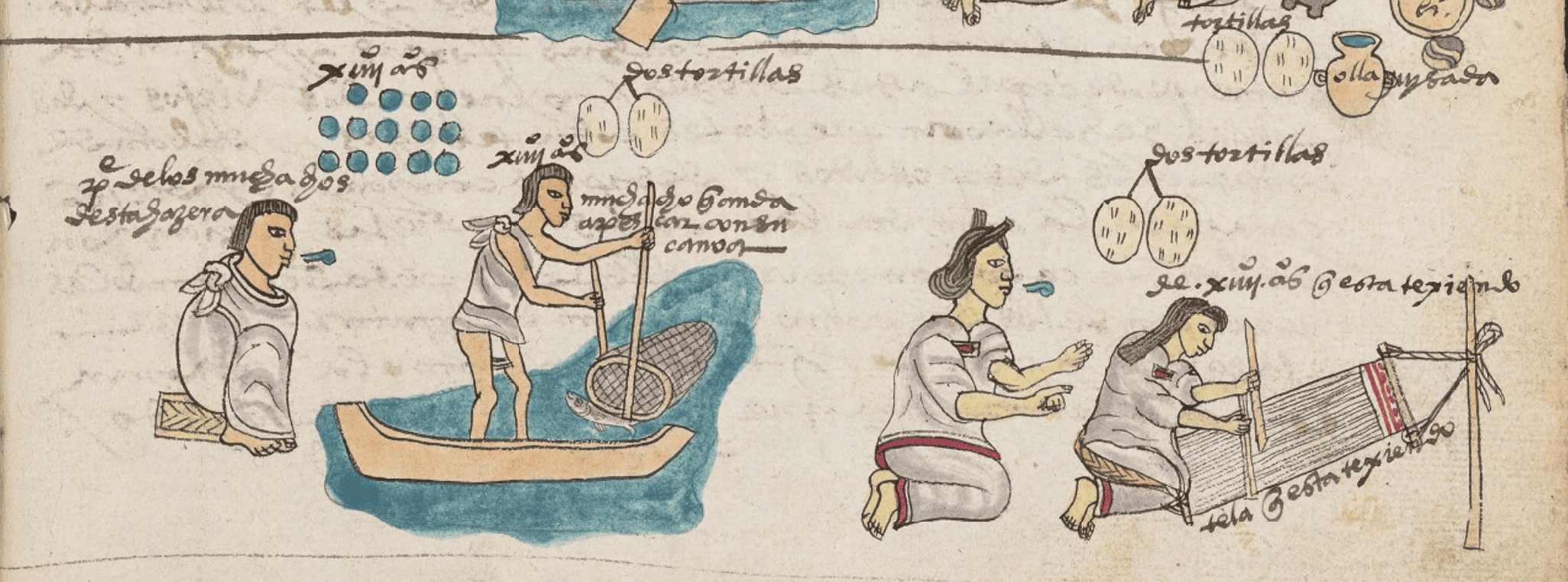

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024