From GI Roundtable 32: Shall I Build a House after the War? (1944)

We have examined one great obstacle to home buying—its high cost. Now let us look at the second—the risk one takes by investing in property.

Very few people ever pay for their homes in one sum, or even in two or three installments. Usually a down payment is made which may be 10 or 20 or a larger percent of the selling price, and the rest is borrowed. As security for the loan the lender gets a mortgage on the property, usually payable over a long period in small monthly installments covering both interest and principal.

Certain costs are involved in completing a mortgage, such as a service charge and perhaps a discount fee. In addition, the buyer has to pay other charges—the commission of the real-estate agent (which, though paid by the seller, is added to the price of the house) and other relatively small charges such as title insurance, the costs of recording the deed, and title search and appraisal fees.

After the down payment has been made and the mortgage signed, title is transferred to the buyer, but with the provision that the transfer is canceled if the payments are not met. In that case, the lender (or mortgagee) can obtain title through legal action (foreclosure). In short, only when the mortgage is entirely paid off does the buyer fully own his house.

The author of many a thrilling melodrama rested the plot of his tear-jerker on the fact that a few decades ago it was possible to foreclose a mortgage the minute a single payment was defaulted.

If they couldn’t scrape together the necessary cash on the payment date, it was pretty tough on the poor old folks and their virtuous daughter. In contrast to the present practice of small monthly payments, mortgages then were ordinarily paid off in lump sums and if the payment was not met the old folks were just out all their interest in the property. So, unless the fair maiden consented to pay the villain’s price for cancellation of the mortgage, or unless—as always happened in the melodrama—the hero arrived in the nick of time with or without the cash to unmask the villain and force him to unhand the young woman, the family was thrown out into the cruel, cold blizzard.

Over the course of centuries, the penalty for not being able to meet the mortgage payments has been lessened. Today, the lender must return title if the borrower who has defaulted can at last make full payment plus all accrued charges within a period which varies according to state laws.

The borrower is protected in other ways. A foreclosure suit may be costly and take much time. State laws vary a good deal in this respect. In Virginia, Texas, and Georgia it takes only a few days to foreclose, but in Illinois it averages over 19 months and in Alabama more than 2 years. In Texas foreclosure is cheap, but in New York and Illinois expensive.

In most states, the debtor who cannot meet his mortgage payments is allowed to rent the house while the foreclosure suit goes through the courts. In some states he can live in it without even paying rent.

Buying a house naturally involves certain risks. So long as one is able to meet the mortgage payments, whether due in installments or in one sum, all is well. But if the payments can’t be made, one has to face the possibility of foreclosure and the loss of the entire investment.

Related Resources

September 7, 2024

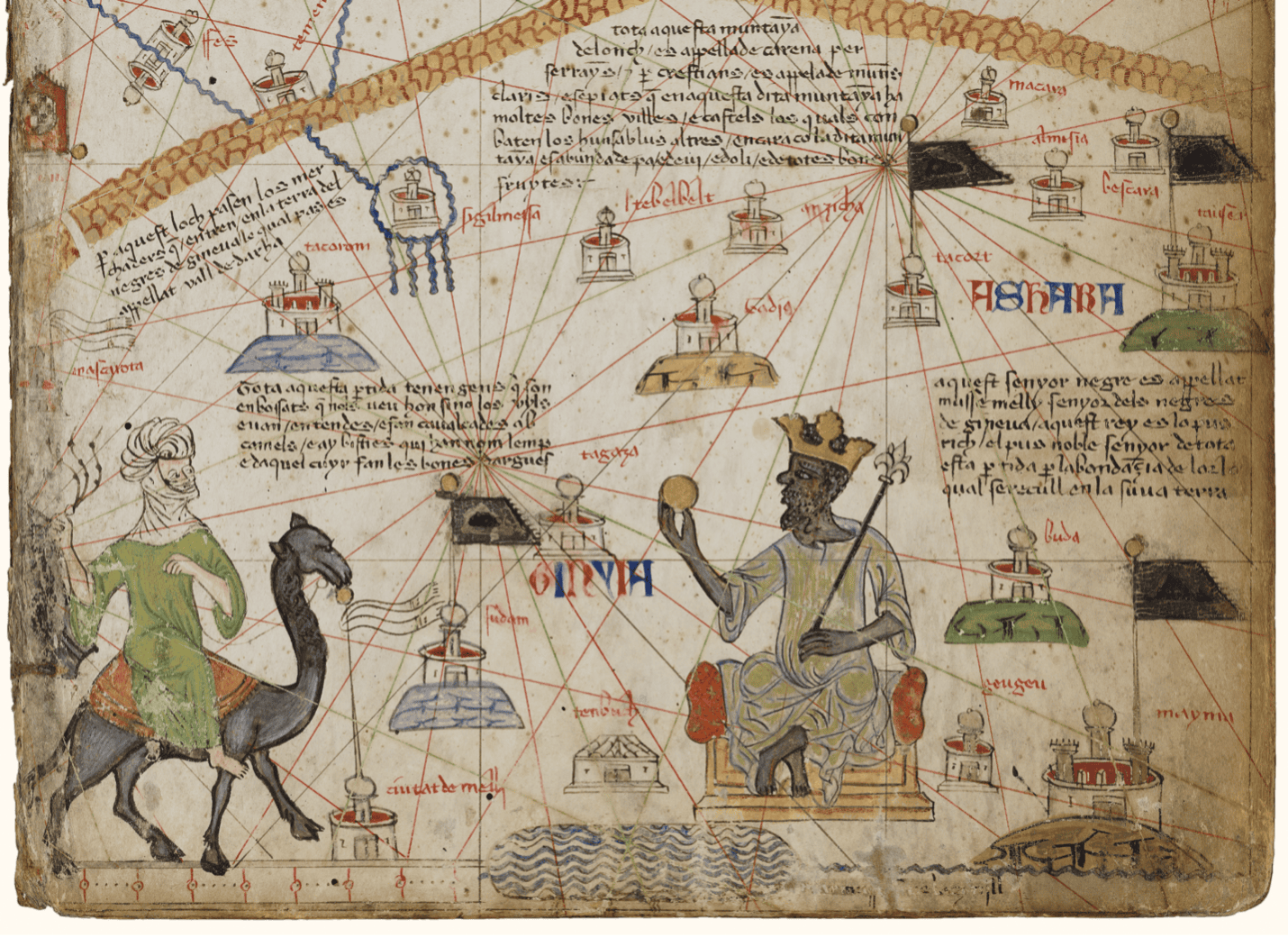

Travel and Trade in Later Medieval Africa

September 6, 2024

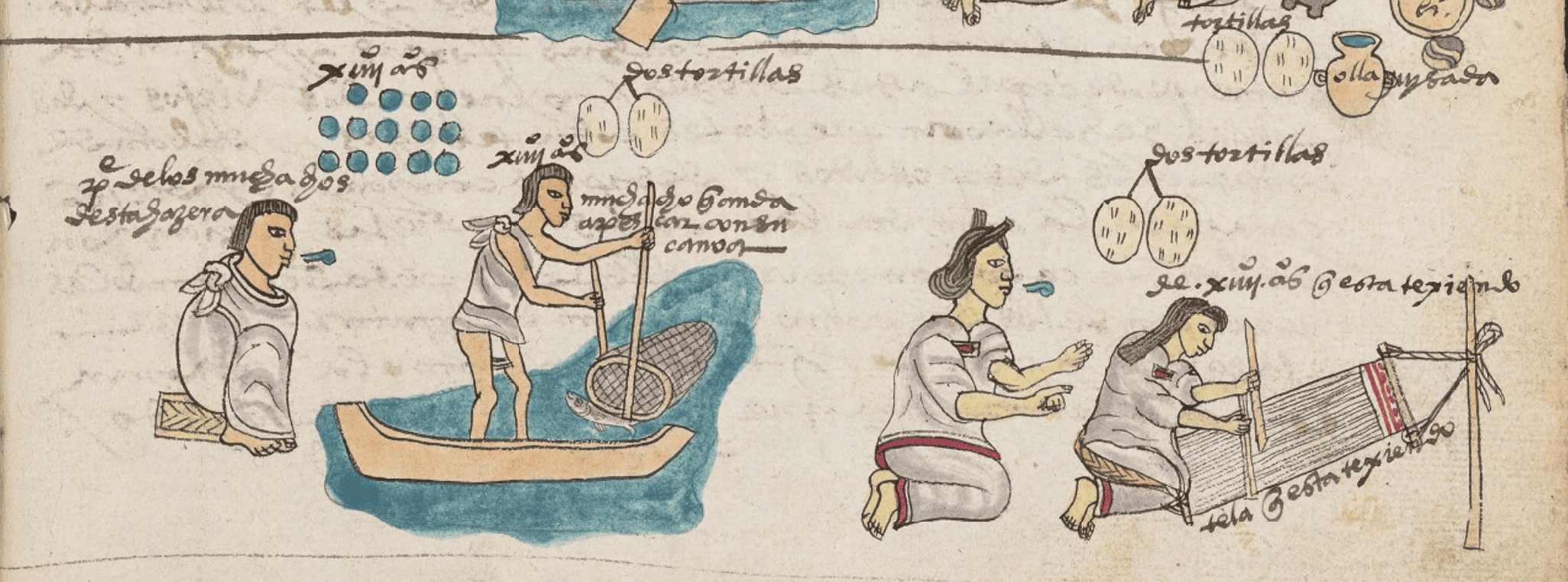

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024