From GI Roundtable 32: Shall I Build a House after the War? (1944)

We have discussed the chief obstacles to buying a home—its expense and the danger of losing the investment through foreclosure. Now let us look at the brighter side of the picture.

In recent years it has been made easier for people to buy homes by (1) increasing the size of the first mortgage, thus largely doing away with costly second and third mortgages; (2) lowering the interest rates; and (3) amortizing the mortgage—that is, making the principal payable in small regular installments over an extended period instead of in one lump sum.

These changes have been accomplished largely with the help of the federal government. Buying a house is now about the same process as buying an automobile on the finance plan—putting a portion of the purchase price down and paying the rest in regular installments-with the exception, of course, that the house costs much more and usually takes longer to pay for. The rate of interest on mortgages, an important part of the total cost of any property, is one thing that has been greatly reduced in recent years. In 1931 interest rates of savings and loan associations on mortgages alone—including special fees or discounts—ranged from 6.2 percent a year in Connecticut to 15.3 in Tennessee.

Furthermore, in 1931 a second, and perhaps a third mortgage, at much higher interest rates than was charged for the first, was often needed in order to buy a house. Thus, if 70 or 80 percent of the selling price was borrowed, 50 to 60 percent would be in a first mortgage and 20 to 30 percent in a second and perhaps a third. The total annual interest payments might then be 2 or 3 times that of the interest on a first mortgage alone. Both first and second mortgages had to be renewed periodically, and a part or all the costs of making the mortgage paid over again.

Market factors, the efforts of private lenders to do a better job, and government action have helped to change the picture. A break in this expensive system was made in 1933 when the Home Owners’ Loan Corporation began to refinance mortgages at 5 percent. In 1934 the Federal Housing Administration set a rate of 5 percent for insured mortgages, plus 1/2 percent a year for insurance and 1/2 percent as a service charge. In 1939 the rate was brought down to 4.5 percent and the service charge was abolished, but the insurance charge of 1/2 percent was kept. In general, interest rates on mortgages are now around 5 percent. Buying property has also been made easier by smaller down payments. The HOLC in 1934 began to lend home owners up to 80 percent of the value of the property, with second mortgages eliminated entirely. Shortly afterward the Federal Housing Administration began to insure mortgages up to 80 percent. Later the FHA increased the figure to 90 and even 95 percent of the value of the property. In defense areas it has required of the buyer little or no down payment.

Related Resources

September 7, 2024

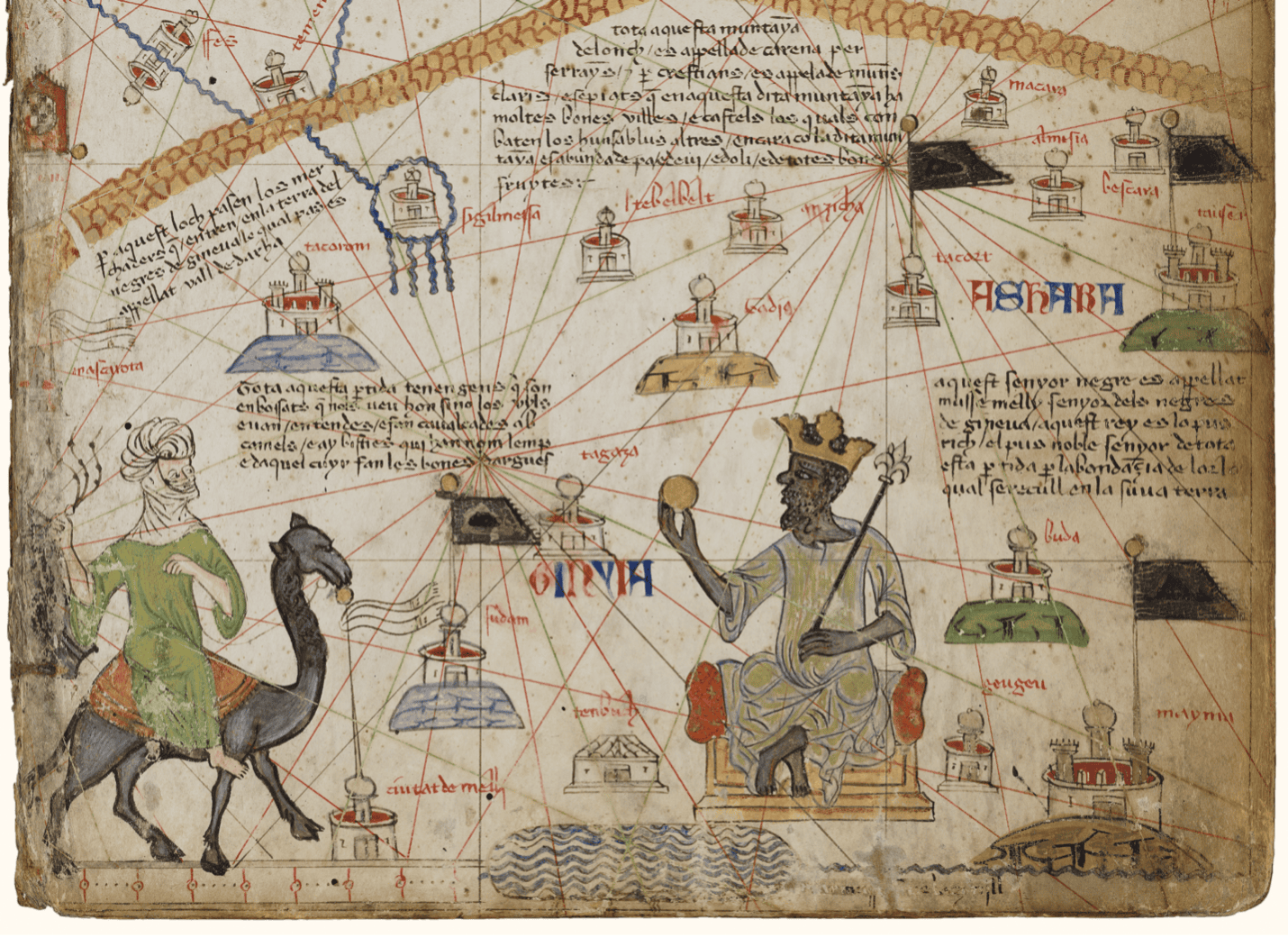

Travel and Trade in Later Medieval Africa

September 6, 2024

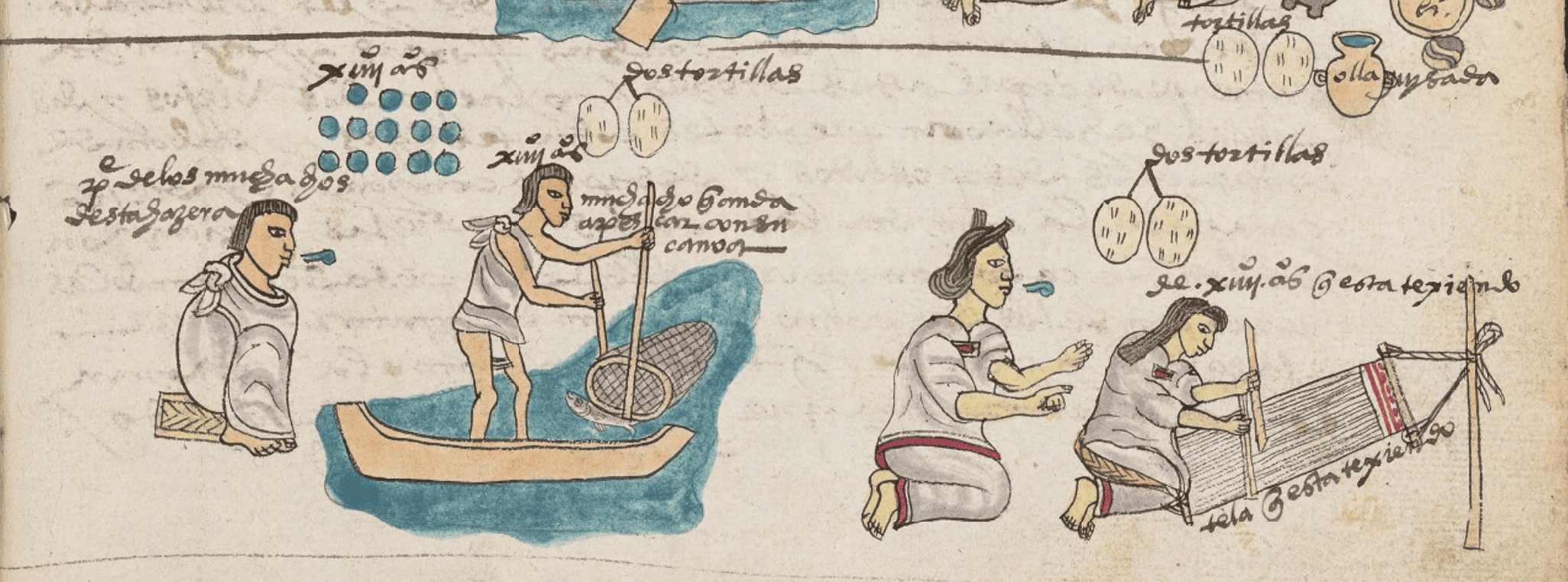

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024