From GI Roundtable 23: Why Co-ops? What Are They? How Do They Work? (1944)

Looked at from the outside, there isn’t much difference between a cooperative and a commercial business. The main difference lies in the way a cooperative works. A cooperative business is set up by those whom it serves and is controlled directly by them.

The earliest American cooperative businesses, the mutual fire-insurance companies, attempted only to meet costs after a fire occurred. Each member was assessed for his share of actual fire losses. Members of the early mutual irrigation companies shared the cost of irrigation services in the same way—after the bills were in.

Service cooperatives still operate largely in this way—for instance, mutual telephone companies, rural electrification associations, health and burial associations, and cold-storage locker service plants. But such cooperatives now, instead of assessing their members at the end of a period, generally estimate costs and make charges in advance. This provides current funds to support the organization and meet expenses as they occur. If the amount of assessments exceeds costs, the assessments for the following year are reduced, or the excess is refunded to members proportionately. Thus, these associations operate on a nonprofit basis.

The first cooperative stores in this country tried to figure out costs in advance and to fix their retail prices so as just to cover the cost of merchandise and running expenses. But it proved hard to determine merchandising costs in advance. Gradually these stores adopted the Rochdale method—selling merchandise at prevailing prices and returning savings to members in proportion to patronage.

Marketing Pools

Many marketing cooperatives operate through “pooling.” The member delivers his product to the association, which pools it with products of like grade and quality delivered by other members. After doing whatever processing is necessary, the co-op sells the products at the best price it can get and returns to the members their share of total proceeds, less marketing expenses.

The products of members may be pooled for short periods. In the case of a creamery, egg marketing, or fruit association, the period may be a month. For crops that can be stored, it may be a year. If the pooling period is a long one and the product can be financed by commodity loans, part payments are generally made in advance. All this is provided for in marketing contracts between the member and the association.

Cooperative livestock commission associations charge for their services on the understanding that the difference between the commissions charged and the actual cost of rendering the service will be returned to members in proportion to the amount of commissions they have paid. The method is also used by many regional grain associations. Cooperative auction associations for poultry, cogs, and fruits and vegetables also operate in much the same way, and so do bargaining associations for milk or sugar beets.

It is this cost-of-service feature—providing members with necessary service and charging them only for the service received—that makes cooperatives different from other businesses. It becomes clear, then, that a “patronage refund” is not a return of profits in the ordinary sense of the word. It is nothing more than an adjustment made in charges for service so that the price paid will be the true cost of service. In the case of a consumer or purchasing co-op, the patronage refund may be looked upon as the return of an overpayment for service, since the gross margin taken usually turns out at the end of the business period to be more than the actual cost of the service. In the case of a marketing association, a patronage refund payment corrects an underpayment, because the association is able to get more for the product after deducting proper costs than it paid to the member.

Co-ops in Action

Suppose that a group wishes to market wheat cooperatively. They form a local cooperative association for the purpose. They must, of course, get an elevator and employ a manager.

When a member wishes to sell his grain, he brings it to the elevator where he is paid in cash the “going” price for wheat in his community. The cooperative elevator then tries to sell the grain—perhaps to a flour mill—for a somewhat higher price. Since it is a cooperative venture, the elevator pays back to the farmer his part of any income made from the sale, or it may credit him on his share of ownership in the elevator. In either case, his return is measured not by the number of shares he may own in the co-op, but by the proportion of grain he sold through it.

If there were a way by which members could be paid at time of delivery exactly what the elevator could sell the wheat for, less costs, there would be no need for patronage refund payments. But this cannot be done, since the local elevator must assemble wheat and sell it in wholesale lots over a period during which the market price goes up and down.

In the case of a commercial elevator, any difference between the price paid the farther when he delivers the wheat and the price the elevator gets from selling the wheat is profit or loss. This is taken by the owners of the elevator in proportion to their ownership. This method of returning net income is the chief difference between a commercial and a cooperative elevator.

Now suppose the local cooperative elevator sells its wheat to a cooperative terminal elevator partly owned by the local elevator as a member of a federation. If there is a saving at the terminal end, it comes back to the local member elevators in patronage refunds paid by the terminal to the locals. In this way, savings both from the terminal and the local marketing operations are sooner or later returned to the individual members of the local associations.

Let us now look at the working of a cooperative creamery to see how pooling is carried on. Here the farmers deliver their butterfat to the creamery in the form of milk or cream. The produce delivered by the patrons is “pooled,” each patron being credited with his contribution to the pool, according to how much and how good his milk or cream is. The period of each pool may be fixed monthly, or semimonthly, or for any other definite period.

As butter is made by the creamery, it is sold on the basis of prevailing quotations, either through a federated sales agency, such as the Land O’ Lakes Creameries of Minneapolis, or other sales outlets. At the end of each pooling period, the co-op’s net income from sales during the period is divided up among its members. The share each member gets is figured according to the amount and the duality of product he put into the pool. The payment he receives, therefore, is in proportion to his patronage, but it is not a refund since no previous payment took place.

This method of marketing, which gives an association rights over the supply of its members, is widely used by marketing cooperatives handling fruits and vegetables, eggs and poultry, and similar products.

Here is how a typical purchasing cooperative works. Let’s take as an illustration a local petroleum association through which a number of farmers get gasoline and oil for their tractors, trucks, and automobiles. The association generally delivers gas and oil to its members by truck and charges competitive prices. At the end of the year any difference between the amount paid in by the farmers (retail price) and the amount paid out by the association (wholesale price), after deduction of expenses, is returned to the farmers as patronage refunds.

Purchasing cooperatives handling feed, seed, farm machinery, or any combination of these, and city consumers’ cooperatives work the same way. Patrons purchase goods at the prevailing retail prices. At the end of the year, the difference between sales prices and the cost of sales is paid to patrons, in proportion to their purchases.

Related Resources

September 7, 2024

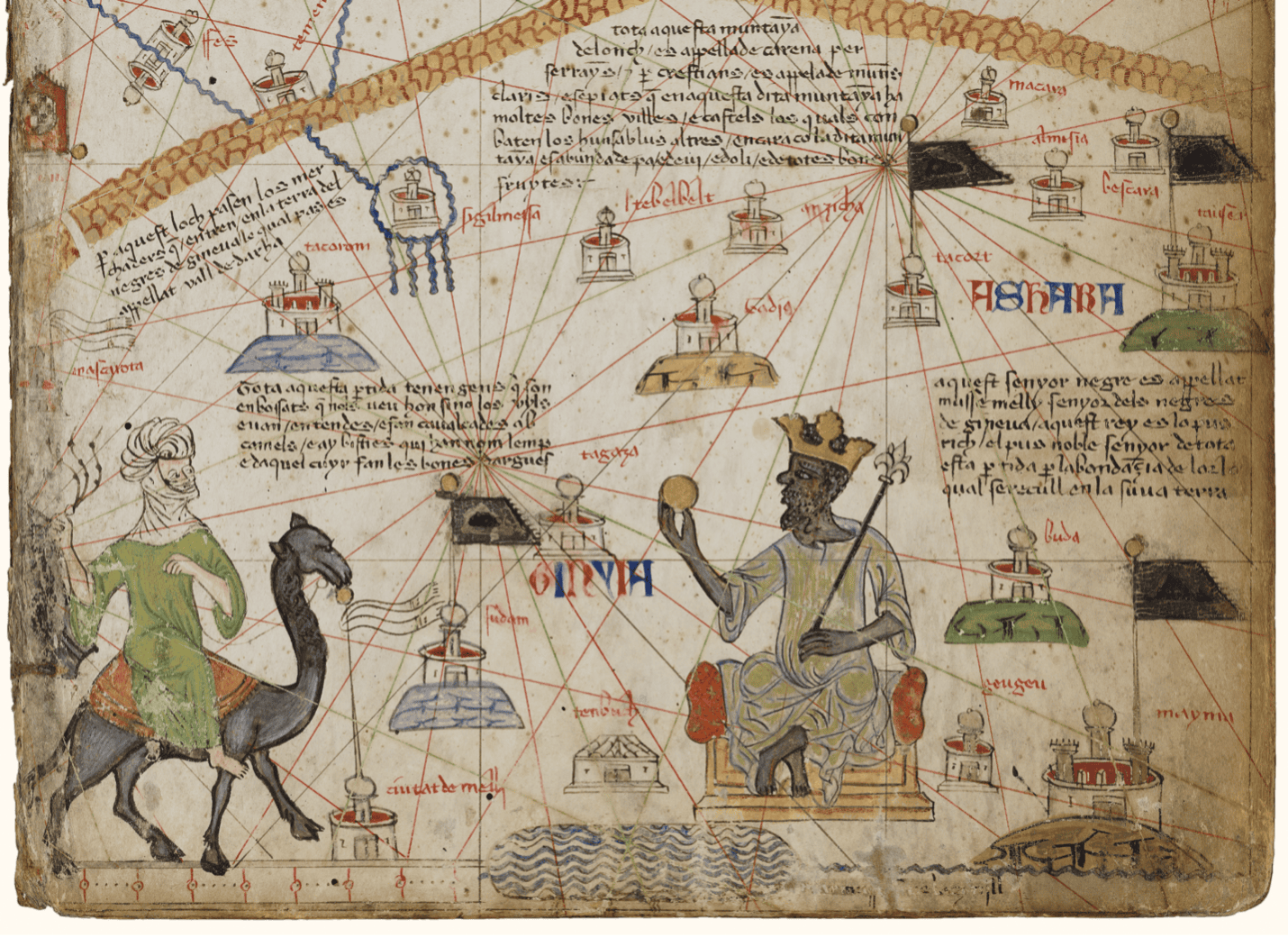

Travel and Trade in Later Medieval Africa

September 6, 2024

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024