From GI Roundtable 39: Shall I Go into Business for Myself? (1946)

Everybody knows that in many kinds of business the large firm has a great advantage over the small one. This is even more true if a small firm tries to break into territory which is dominated by big corporations. You would not, for example, be well advised to resume your civilian career by trying to put a new brand of cigarette, gasoline, or automobile on the American market. It would be sheer madness to try to compete with the established giant firms in such industries.

If the field was entirely new, as was that of automobile production in the early years of this century or that of radio in the early 1920’s, there might be a chance for all to try their luck. If you could think of some desirable product which no one else was making—such as the dry-ice union suit for hot weather suggested by a Baltimore professor in the 1930’s—you could get away on a small scale during the first summer, grow rapidly, and rake in the monopoly profits of your brain child until competitors appeared and made the article so plentiful and cheap that it could be bought in the chain stores or mail-order houses. The odds are that eventually many of the competitors would kill each other off, and production would settle down in the hands of a few large firms. When that condition was reached, little men would have small chance of invading the market.

The advantages enjoyed by large units are too obvious to need detailed description. The big fellow can get a lot of capital or credit cheaply, especially when his firm is known to be flourishing. He can buy in great volume at low prices. He may even own his sources of supply—coal or ore mines, forests, power stations—and have his own string of ships, freight cars, oil tankers, or trucks.

His production takes advantage of the opportunities for a high degree of division of labor. He has machines and workers for each process or part of a process, and may be able to keep them busy all the time. Since his machines are so designed that they do exactly what is required of them, he is able to use workers who possess no great skill and need little training. He can make all the parts he needs for his assembly line, or carry the material through all its stages from the raw state to the finished article.

He has enough work to keep specialists busy dealing with problems of management, maintenance, repair, scientific research, finance, accounting, labor relations, public relations, and selling. He can take advantage of any, patents that come his way or of any discoveries made in his laboratories. He can find uses for his by-products. Finally he can advertise on a national or international scale, put costly programs on coast-to-coast radio networks, and set up his own wholesale or retail selling systems.

His big rivals, if he has any, are probably few in number. They must respect him as he is bound to respect them. All of them may reach some formal or tacit agreement not to fight each other too fiercely, especially in cutting prices.

What chance for a little fellow?

Thus the large firm has marked advantages over small ones as buyer, producer, and seller. The relative cheapness of many of America’s standard products when compared with those of other industrial countries is in a great measure due to our exploitation of these advantages, especially in the use of machinery and power, to serve a market which is large enough to absorb the products of mass production.

In contrast to the large producer, the little man may be short of capital. He cannot get his funds by selling stocks or bonds, and the bank may not be disposed to finance him except at a rather high rate of interest until he has shown that he is a good safe risk. He has to buy materials in small quantities and therefore at a higher cost. He cannot use a lot of highly specialized machines or workers all the time, or make all the parts he needs.

He may have to be his own production manager, ales manager, hirer and firer, accountant, and general factotum; and while he may be good at one or two of these jobs he has not time or ability to do them all well. He cannot afford ambitious sales campaigns, and has to sell wherever he can find buyers—which may not be easy. The fact that he is operating in a small way may expose him to competition from a multitude of rivals, and the greater the number, the smaller is the hope of getting all to agree on plans which will limit, regulate, or eliminate competition.

If you set the situation out in these bold terms, the little man does not seem to have a ghost of a chance. But, as is usual in human affairs, no simple sweeping generalizations can cover the vast variety of conditions and possibilities. When we get down to earth to explore actual situations, we find that there are many occupations in which large capital sums, extreme division of labor, machines, and scale of operation are not the all-powerful factors and in which the economies of mass production do not emerge.

Typical Operation of a Retail Hardware Store, 1939

| Net Sales | $24,300.00 | 100.00% |

| Cost of Goods Sold | $17,228.70 | 70.9% |

| Total Expense | $6,488.10 | 26.7% |

| salaries of owners | $2,162.70 | 8.9% |

| wages of employees | $1,846.80 | 7.6% |

| occupancy expense | $972.00 | 4.0% |

| advertising | $218.70 | 0.9% |

| bad debt losses | $145.80 | 0.6% |

| other expenses | $1,142.10 | 4.7% |

| Profit | $583.20 | 2.4% |

The limits to largeness

The nature of the demand has quite a lot to do with determining the best size of unit for supplying it. The demand for cement, steel, copper, electricity, gasoline, newsprint, and most other raw or semimanufactured materials is so standardized that a large plant can safely produce vast quantities of goods all identical in quality. The same may be true of the finished goods which we, the general mass of consumers, buy. It used to be said that we liked the things we bought to be different from those our neighbors possessed and to suit our own tastes.

There was and still is some truth in that assertion. One person buys a certain style or pattern of furniture and thinks it is beautiful, yet another would not “give it houseroom.” Our tastes in clothes, shoes, food, house plans, or chinaware, like our tastes in books, music, comic strips, or movies may vary so greatly that no one standard product will suit us all.

Large producers have had to recognize this fact. There was a time in the early history of the automobile industry when one manufacturer said he would give his customers any color of car they wanted—so long as it was black. But there soon came a time when car buyers wanted variety, and not merely in color. Hence in the automobile industry, as in many others, the large producers have had to give us a range of models, with different sizes, shapes, patterns, color schemes, qualities and prices to suit our tastes, needs, and purses. They did not go the whole hog and ask, “What do you wish?” but rather said, “Here they are. Take your choice.”

In that way most of us may be satisfied, for it may be better to have an article you don’t quite like than to do without one at all. Yet there are enough of us left to prevent the mass producer from conquering all the market. Men who can afford it may still prefer to have their suits made by a tailor. Women who can afford it patronize shops which do not specialize in mass sales. The smaller producer is able to offer us greater range of choice and shift his styles more rapidly when the old ones lose their appeal.

Likes and dislikes

Even when the customer has only a small variety of goods from which to pick, his choice may be influenced by the behavior of those who strive with each other to supply him. Few of us have had any insight into the way a seller of steel or cement goes about the job of winning a customer. But we have all been worked on by many other types of salesmen and can recall reasons why we bought what we did, why we bought it from A rather than from B or C or D and why in future we always will—or never again will—buy that brand or buy it from that salesman.

Perhaps you did not buy a certain household gadget because, when you heard the price and said, “I can’t afford it,” the salesman snappily retorted, “You can’t afford to be without it.” Perhaps you buy from the neighborhood grocer or druggist, though you are aware that his prices are higher than those downtown. But he knows your name and your tastes, his small talk flatters your sense of importance, he’ll deliver and charge your purchases, he’s always ready to cash a check, and when cigarettes are scarce he can be relied on to hold back a couple of packs for you.

You might save a nickel or dime on the dollar by going to a big drugstore downtown or the grocery supermarket across town. But there is the gas and time and parking problem to be considered. And maybe those stores are always crowded when you are free to go there, or the service does not impress you favorably. Perhaps you once had a long wait for some goods from a mail-order house and a longer wait to get them changed. It may be that you patronize some brand or store because you like its radio commentator or comedian or commercials—or perhaps you don’t buy because you dislike one, two, or all three.

One could go on indefinitely recollecting such experiences, either in buying goods or in getting haircuts, meals, medical service, or entertainment. The lesson to be drawn from them is that the size of the servant may be less important to the consumer than the convenience and quality of the service rendered. There are excellent large servants and excellent small ones, and there are also bad ones in all sizes. The little man is often at no serious disadvantage. He may not be able to get along with quite such small margins between wholesale buying and retail selling prices as the large; distributor. But if his heart and mind are in his work, if his tact is on his tongue, and if his quality gives full value for money received, satisfied customers: will return to his unpretentious door and he is likely to make good.

Bigness may cost too much

In some fields of business the small firm can survive because bigness costs too much. We correctly think of the large firm as a great employer of labor and a vast user of machinery. But the labor and the machines have to be paid for. Each adds a large item to the cost of running the enterprise, and if each cannot be used to the full, the firm may not get its money’s worth out of them.

Take the case of labor first. If you pay a man so much a week, you want to be able to give him and get from him a full week’s work. Furthermore, it is desirable that you keep him working week after week doing the job for which he trained himself or the one you taught him. But suppose you cannot keep him going all the time, or he does not have a chance to work to his full capacity, or quits his job and you have to find and train someone else to take his place. Then the labor cost of the things he turns out may be higher than customers can afford to pay.

Or take the case of the machinery. By using it you may save in labor costs, but you increase your capital costs. It has been estimated that on the average we have about $5,000 or more invested in plant and equipment for every American factory worker. On the railroads and in the steel plants the figure may be several times that. This equipment depreciates in value even if it is idle. It costs money for maintenance and repairs when it is in use. Some of it quickly becomes obsolete and may have to be scrapped. Yet its owners expect in to yield them at least as much interest as they would have obtained if they had put their money into some gilt-edged investment.

Consequently machinery may be costly and unprofitable unless it can be used all or most of the time and can reduce the cost of production so much that it pays for itself before it is worn out or out of date. If you put $1,000,000 into machines and have to scrap them in a few years, the capital cost has been heavy. And if they are designed for one special kind of job—such as shaping a front left fender for a 1942 car—they may cost a lot of money and time to change for making the fender of a 1947 model.

Efficiency makes the difference

The efficient use of a lot of labor and equipment therefore depends on the ability to use both almost continuously. In some occupations that is impossible. The classic illustration is, of course, farming. Even on the best-planned farms, work has its seasonal busy periods and slack times. A machine that is designed for seeding may be no good for anything else. A combine harvester can be used only for harvesting and has to be idle, eating up a lot of interest and depreciation, during many months of the year.

Besides, agriculture depends in a high degree on actual skill, on making decisions, and on carefully considered judgments about trends and prospects. No machine can think judge, or decide. There were some farmers who did fairly well during the dark depressed days of the early 1930’s, when most of their neighbors were facing ruin. Their welfare was the reward of superior personal qualities of skill, planning, strategy, and tactics. The same personal qualities are of vital value for every other kind of small enterprise. Men rather than machines make or mar them.

Can little businesses get the benefits of bigness?

The right policy for the small businessman is to try to make the best of both possible worlds by gathering in some of the benefits which are enjoyed by large-scale enterprises. He must do his central job on his own; but for everything he needs before or after he does it, he may be able to benefit by cooperating with those he regards as his rivals.

Here again the farmer gives us a good illustration. His central task is farming. But before he gets at it, he needs capital to buy or improve his land, to erect his buildings, to obtain his implements and livestock, and to secure the seed, fertilizers, feed, and so on, for the season’s operations. When he has got his product, it may need processing—into cheese, butter, or bacon, for instance—or grading and packing. Then it has to be transported to market and sold. His net income depends on the difference between the price he gets for his produce and the price he has to pay for capital, materials, processing, transportation, and so on.

As a small borrower or buyer he will probably pay high interest rates and d prices. As a small processor he cannot afford elaborate equipment or use the most efficient mass-production methods. As a small seller he may get a low price, be competing with a lot of other vendors, and be limited in the range of his market. But if he and his kind get together in a producers’ cooperative organization they can create in essence a large borrower, buyer, processor, and seller, and benefit all down the line in reducing costs. They may even limit competition so much that they can do something to raise prices.

The benefits of cooperation

Little businessmen the world over can profitably take heed of the way the small farmers in parts of Europe, Asia, and America have sought and found strength, lower costs, and higher net income through cooperation.

There is no room here to tell in detail of cooperative credit banks, purchasing societies, creameries, and sales organizations. The results are not merely those which were definitely sought—lower costs and interest rates, large-scale efficient processing, and stronger marketing methods. The farmer’s own methods and standards of production have been improved also. He has had to be more careful in his borrowing and repayment, get better livestock, and generally toe a line that is far ahead of the old one. He has had to realize that smallness is no virtue in itself and as such entitled to pity or a pat on the head.

Sometimes he might think it would be easier to seek government aid, and in some cases the government proffered that aid of its own accord. But a number of bitter experiences in many countries have suggested that the less he leaned on his government or sought its help in making the obligations of cooperation less heavy, the more healthy was his voluntary joint effort likely to be.

Some other fields of small business have followed the example set by the farmers. Retailers have organized grocery or drug associations which can buy in greater bulk, advertise more widely and cheaply, give expert merchandising advice, and thus raise the storekeeper’s efficiency in his competition with the chain stores. Yet the frequency with which some of these stores close up or change hands shows that membership in an “independent” group does not insure against failure.

The high cost of competition

In other kinds of enterprise it may not be so easy to reduce costs, but it may be highly desirable to prevent prices from being pushed too low by fierce competition. That kind of competition is inevitable in times of depression. It is also likely to emerge when a new line of service or sale—such as permanent waving or dry cleaning or auto repairing—yields such high returns to those who are first in the field that swarms of newcomers rush in to share the spoils. Eventually the flood must subside, but meanwhile it may have depressed prices to a level which gives a very scant livelihood to even efficient survivors. If they can get together and agree on certain common standards—such as the charges to be made or the hours of business—then the occupation can become stabilized at a reasonable rate of reward for those who practice it.

During the last ten years many of the small-scale enterprise fields have gained some of that stability so far as prices and hours are concerned, while in some states laws to prevent price-cutting may have achieved some of their purpose. Sometimes a cut-rate drugstore doesn’t cut rates, but only whittles them a trifle. It is difficult to find a barber who will trim your hair for less than the standard rate, and you may discover that garages are all charging about the same price for the services they offer.

In moderation this putting a belt around rivals is all to the good for both buyer and seller. We have long since passed the point where we assume that unfettered competition is completely good. If competition were a sort of game played according to gentlemanly rules, it might be fun. But when it becomes a tooth and claw fight, with no holds barred and with hitting below the belt a general practice, then everybody suffers in the long run. If, however, the restriction of competition should become immoderate and if plundering the public should become its aim, there would probably be a buyers’ strike or an inrush of new sellers to take advantage of the high rewards, and the solid front would be broken.

Related Resources

September 7, 2024

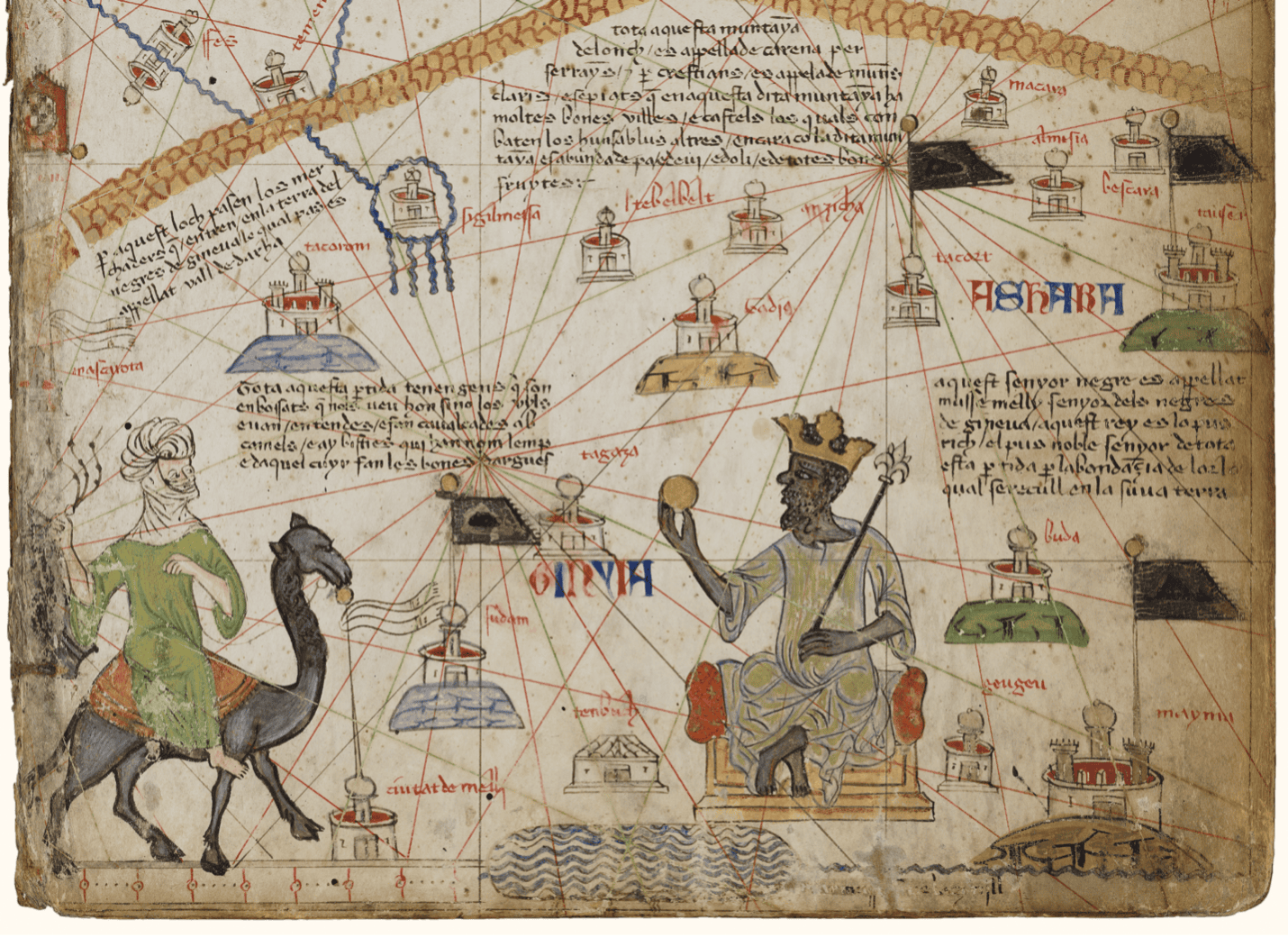

Travel and Trade in Later Medieval Africa

September 6, 2024

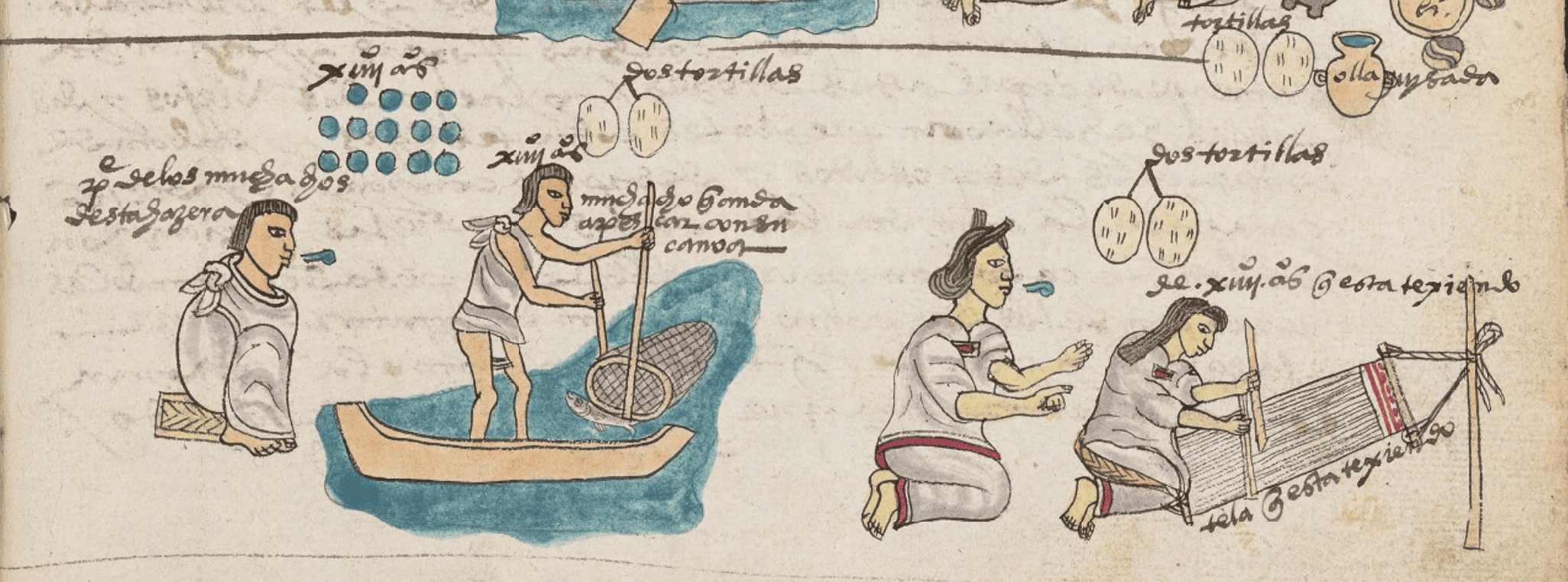

Sacred Cloth: Silk in Medieval Western Europe

September 5, 2024