“I was looking to borrow $500, so I filled out the online forms,” explained Walter Archer, a truck driver and father of four who was featured in the 2018 Netflix documentary series Dirty Money. Archer had borrowed from an internet-based lender called One Click Cash based on his understanding that he would pay a fee of $150 for $500 borrowed. “I knew $150 was a little bit on the high scale,” he said, “but I wasn’t too terribly worried about paying it back.” It was only later that Archer discovered that he had taken out a “payday loan” and that the lender would charge him a new fee every two weeks until the loan was repaid. The cost of the loan, measured as an annual percentage rate (APR), was 782.14 percent.

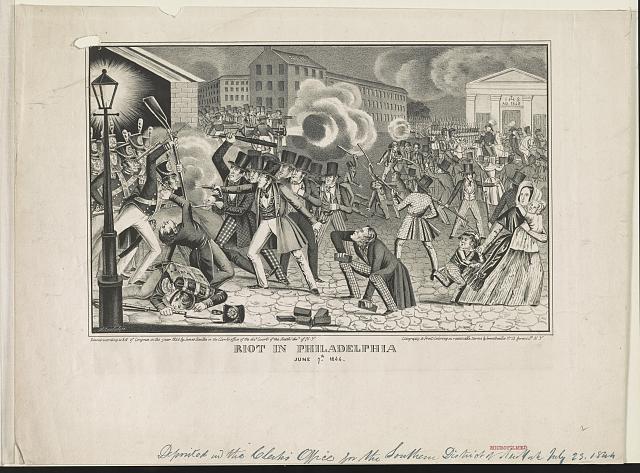

Policymakers are proposing plans to cut the demand for payday loans charging exorbitantly high interest rates. Taber Andrew Bain/CC BY 2.0/Flickr

Over the past several weeks, policymakers have proposed a range of schemes to put payday lenders like One Click Cash out of business, or at least diminish the demand for their products. Payday loans are a controversial form of small-dollar, short-term borrowing that typically cost customers around $15 for every $100 borrowed, equivalent to an APR of more than 300 percent for a two-week loan. Some have compared payday lending to legalized loansharking.

In response, federal officials recently unveiled several proposals to reduce households’ reliance on payday loans. The National Credit Union Administration, which supervises credit unions, announced plans in early June to expand the variety of “payday loan alternatives” that federal credit unions are allowed to offer. The Office of the Comptroller of the Currency, which supervises national banks, proclaimed in late May 2018 that it would encourage banks to offer short-term, small-dollar loans. Finally, in late April, US Senator Kirsten Gillibrand proposed new legislation to create a Postal Bank that would offer basic financial services, including small-dollar loans, in every post office location across the nation. “Millions of Americans are being forced into payday lending schemes that only exacerbate their money problems,” Gillibrand explained. The Postal Bank aims to “wipe out these predatory practices.”

Payday loans are a controversial form of small-dollar, short-term borrowing that typically cost customers around $15 for every $100 borrowed.

Concerns about high-rate, small-dollar loans are not new. Over a century ago, in the early 1900s, urban reformers launched the first campaigns against the “loan shark evil,” targeting cash lenders that charged up to 500 percent interest per year for small loans to working-class borrowers. To be sure, this history does not tell us how to tackle the modern problem of payday lending. But it can provide necessary context for policymakers and everyday people to understand the current fight for lending reform, revealing what is truly novel about our present moment and what is merely an echo of the past.

All three federal proposals to reform the short-term, small-dollar lending marketplace rest on two old ideas: first, that tighter regulation cannot wipe out the demand for small-dollar loans and, second, that spurring competition with existing lenders offers the best means to protect borrowers from loan sharks. Both principles date back to the earliest campaigns against high-rate small-dollar lending. The Russell Sage Foundation, established in 1907, spearheaded early efforts designed to harness the power of competition to rid American cities of loan sharks. The foundation championed “remedial” lending by semi-philanthropic private societies, which raised capital to lend from wealthy investors and, in exchange, paid them a small, fixed dividend on their contributions.

Together with representatives of industry, the foundation also drafted a model state lending law that would encourage “honest capital” to enter the small loan business by raising interest rate caps for small-dollar loans. The foundation lobbied for passage of the law, known as the Uniform Small Loan Law, in states across the nation. When lawmakers recoiled at the idea of allowing lenders to charge rates as high as 3.5 percent per month, the foundation explained that lower rate caps of 6 or 7 percent per year merely drove the small-sum lending business underground. They did not cause the business to cease operations or lessen the demand for loans.

The foundation opined that the shortfall between workers’ wages and their cost of living, along with “enforced idleness, unexpected illness and similar emergencies,” made borrowing a necessity. These conditions “cannot be eliminated without the entire remodeling of our whole social and economic system,” it explained. Unwilling to scrap capitalism, early 20th-century reformers seized upon regulated competition as the next best option. And thanks to the Sage Foundation’s campaign, the Uniform Small Loan Law was widely adopted over the course of the 1920s. By 1930, at least 25 states had the law, or a similar measure, on their books.

Not all present trends are rooted in the past, however. Comparing the 1910s and the 2010s can create a sense of déjà vu, but some aspects of recent policy changes do represent a profound departure from past practices. For example, although the Office of the Comptroller of the Currency’s guidance describes banks as having “withdrawn” from the short-term, small-dollar loan market, banks have never been a reliable source of credit for working-class households. Prior to 2013, some banks did offer “deposit advance products” that allowed customers with recurring direct deposits to borrow against some portion of their next regular deposit for a set fee. But for most of the past century, banks have not catered to those in need of small-dollar, short-term loans.

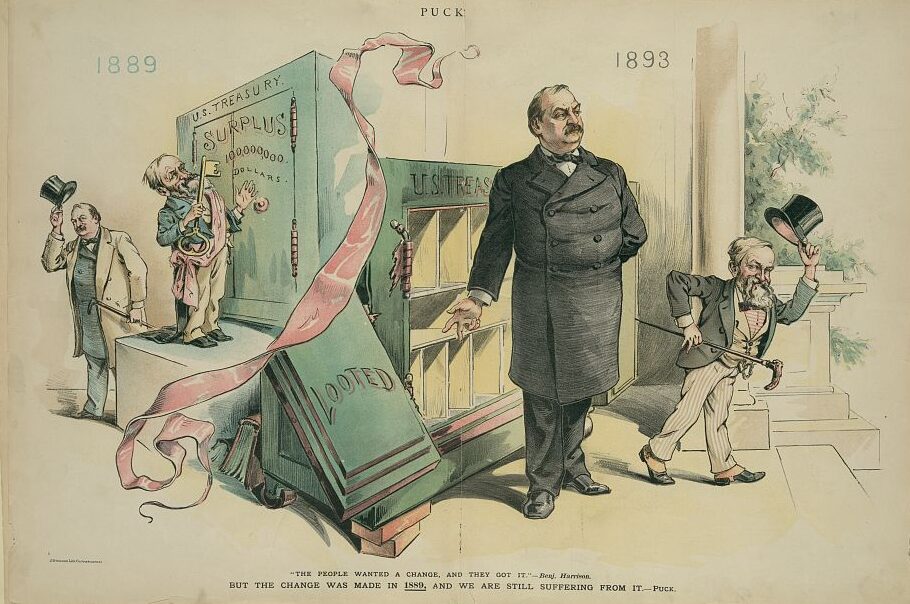

Postal savings is an old idea, but postal lending would be entirely new in the United States.

As I explain in my recent book, City of Debtors, banks did not begin offering small personal loans until the 1920s, at the urging of consumer advocates who sought to cultivate lower-cost sources of small loans. Once banks entered this market though, they served mostly white-collar, higher-income borrowers, while finance companies helped those of more modest means. If banks do begin offering small loans to the working-class households who now borrow from payday lenders, this will represent a new era in banking lending, rather than a return to form.

The same is true of postal banking. Postal savings is an old idea, but postal lending would be entirely new in the United States. The postal savings banks of yesteryear did not offer loans. Rather, they provided small depositors with a safe place to store their savings, albeit at the below-market interest rate of 2 percent per year. They also granted additional stores of capital to local commercial banks, where the post office ultimately deposited most of the aggregated savings of its customers. As US Senator Thomas H. Carter, the chief sponsor of the original postal banking legislation, noted in January 1910, lawmakers hoped that postal savings would inculcate “habits of industry, frugality, and thrift” among the citizenry and “bring into circulation millions upon millions of money now dormant and in hiding.” Postal lending represents an innovation, not a reversion to an old practice.

As history shows, fixing the small-sum loan market has proved enormously challenging. Those who tried in the 1910s would not be surprised that problems remain in the 2010s. The shortfall between workers’ wages and their cost of living, along with unexpected emergencies, still drives demand. Warriors of the earliest reform campaigns would recognize much of their thinking in modern attempts to tinker with the available supply of small loans. But the latest round of reform proposals also quietly introduces some novel tactics and offers hope that maybe this time, things will be different.

Anne Fleming is associate professor of law at Georgetown University Law Center. She is the author of City of Debtors: A Century of Fringe Finance (Harvard Univ. Press, 2018).

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. Attribution must provide author name, article title, Perspectives on History, date of publication, and a link to this page. This license applies only to the article, not to text or images used here by permission.